of having choices

for what matters most

that comes with

financial security

a legacy

because someone planted a tree

a long time ago”

– Warren Buffett

CONFIDENTLY

Invest with Confidence. Live on your terms. Pursue what matters

Invest with Confidence. Live on your terms. Pursue what matters

“If we create financial freedom for ourselves, the extra mental, emotional & spiritual space we free up will allow us to operate as our best selves in this lifetime”.

–Kate Northrup

What I can help you with

Developing financial strength to quit a toxic job & start a dream second career

Highly personalized & strengths-based approach to investing

Highly simplified investing

My philosophy & approach

My intent is to empower you to be able to make your own financial decisions confidently & sleep peacefully. At the end of the day, only you know your own personal situation, temperament & context best. Besides, it’s your hard-earned money so no one but you should make the choices with regard to your finances & investment.

I believe in a Sattwic approach to investing i.e. I believe that a solid financial foundation is built slowly & steadily by making wise & mature decisions and investing consistently over a long period of time. There are no short cuts to financial freedom. I do not believe in aggressively chasing high investment returns, competing with or comparing investment performance with others among friends & family, or taking undue risks in order to reach financial goals.

I hope to be able to demystify investing and make it as simple as possible for everyone. I am confident that if you educate yourself on sound investment principles, develop good financial habits and stay away from typical investing pitfalls you will benefit greatly.

The confidence & knowledge to invest independently

Peace of mind knowing you are on track with your goals

More time to pursue your dreams

Investment Coaching Vs Advice

Investment Coach

- Focus is on Self-empowerment. Educates you by simplifying complex investment concepts and guides you in making your own investment decisions.

- Focuses on an in-depth understanding of your personal context with regard to investing

- Focuses on applying your natural strengths for investing success

- Focuses on mindset, good investment habits & principles, decision making frameworks & behaviour rather than specific investment recommendations

- Helps you develop confidence, discipline and avoid mistakes

- Works as a mentor or trainer rather than a financial professional

- Doesn’t earn commissions from financial products.

- Charges a flat fee / hourly rate, for one on one personalised coaching sessions

- Full privacy & confidentiality: Does not need to know actual amounts you have invested

- Is a certified coach

Investment Advisor

- Provides specific financial advice and recommends investment products (stocks, mutual funds, bonds, etc.).

- Creates your financial plan & manages your portfolio

- Lack of confidentiality: Most often knows exact amounts invested

- Can directly handle or execute investments on your behalf

- Charges a fee based on AUM (Assets Under Management)OR commissions from financial products OR flat fee

- Is a certified finance professional

Investment Education

Optimizing portfolio longevity & end value: Excerpts from Bengen’s research

Key takeaways For a 4% SWR & 50% equity allocation no one had less than about 35 years before his retirement money was used up. For a 3% to 3.5% withdrawal rate even a 50:50 equity debt portfolio always lasted…

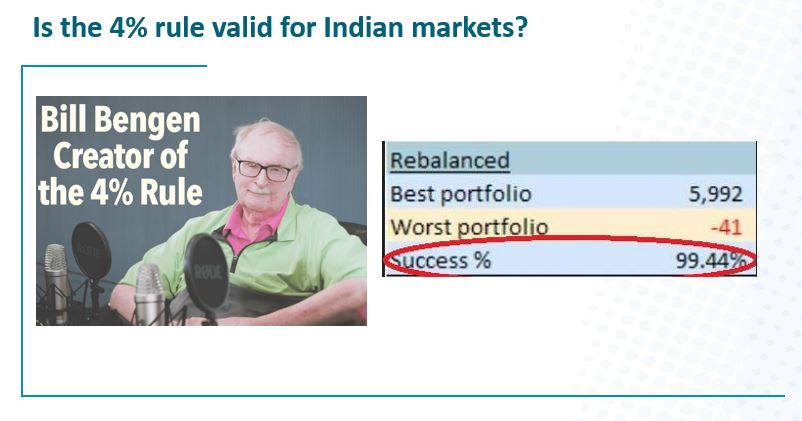

Does the 4% rule work in the context of Indian markets?

Key takeaways The 4% rule is critical because it helps calculate what portfolio value you need in order to retire safely Looked at another way, it is also critical because it tells you how much you can spend in retirement…

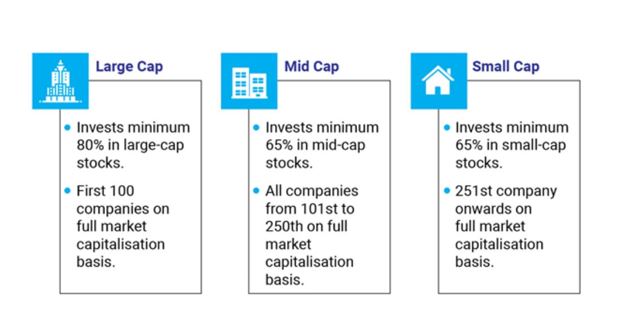

Market cap & sector risk in equity funds

Key takeaways In the short term certain fund categories can generate astronomical returns But most such funds also carry a high risk & probability of falling as hard as they rise If any fund you own is generating high returns,…

Want higher returns? There’s an almost sure way. But beware the flip side !

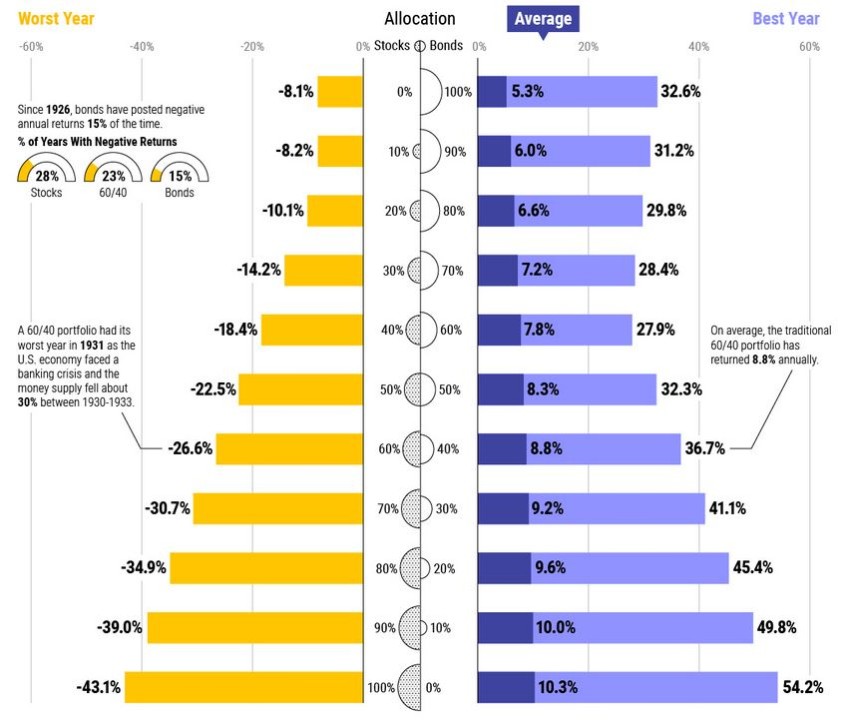

Key takeaways: Increasing the percentage of equity / stocks in your portfolio is a near sure fire way to increase the long term returns from your portfolio But increasing equity / stocks also makes your portfolio much more volatile in…

Unusually high investment returns? Beware & give it a closer look !

Key takeaways More risk = More return & Less risk = Less return If a scheme promises high returns with low risk it’s most probably a scam When we see high returns we normally never seek to question them On…

3 basic risks to be prepared for when investing in equity & how to manage them

Key takeaways It’s easy to get carried away when we see attractive returns from an investment This is when we need to look at the other side of the coin & make sure we do due diligence on the risks…

How much you can spend with a certain net worth at retirement in India

Key takeaways Due to various circumstances, many of us may not be able to reach the ideal retirement target number To deal with this we work backwards from our net worth to know how much we can spend Ravi Saraogi’s…

Improving chances of hitting your retirement goal with intermediate milestones

Key takeaways Planning for retirement can be discouraging given how far away the goal typically is & how slow the initial progress can seem Creating intermediate milestones to retirement can encourage you stay on track for the retirement goal Having…

13 potential risks & hassles of investing in real estate vs Mutual funds

Key takeaways Hera are the list of potential risks or difficulties when one buys a property: Difficulty in determining fair price of purchase / sale Difficulty in ensuring clear title to property Large amount needed to even just get…

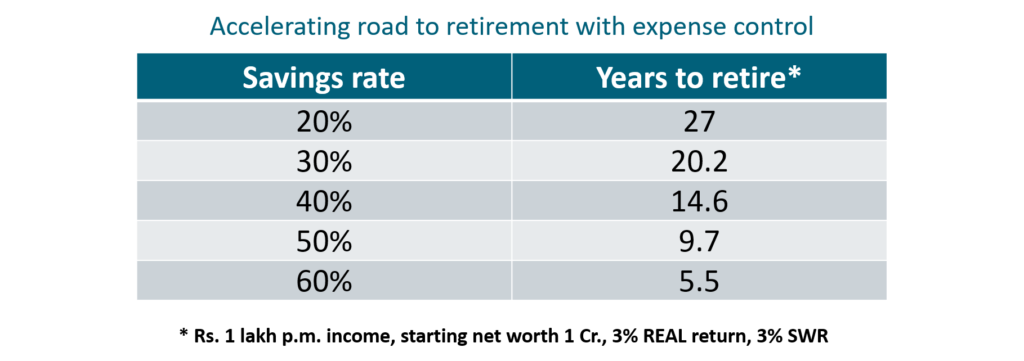

Accelerating retirement with expense control

Key takeaways Numbers thrown up by retirement calculators can look scary & unachievable at times In response, many try to get aggressive by investing in schemes that promise high returns. But this is most often a mistake since it…

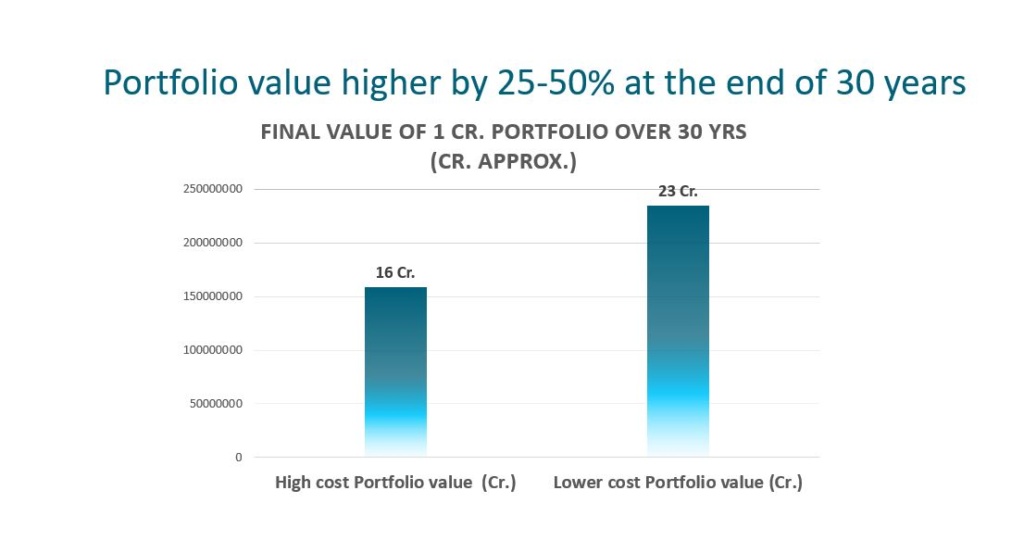

How to get to a portfolio value higher by 25-50% at the end of 30 years

Key takeaways A 1% fee of assets under management can seem small but is not in the long run Arthgyaan has shown that, over a lifetime, for a 25,000 SIP per month the difference comes to 9.4 crores Rob Berger,…

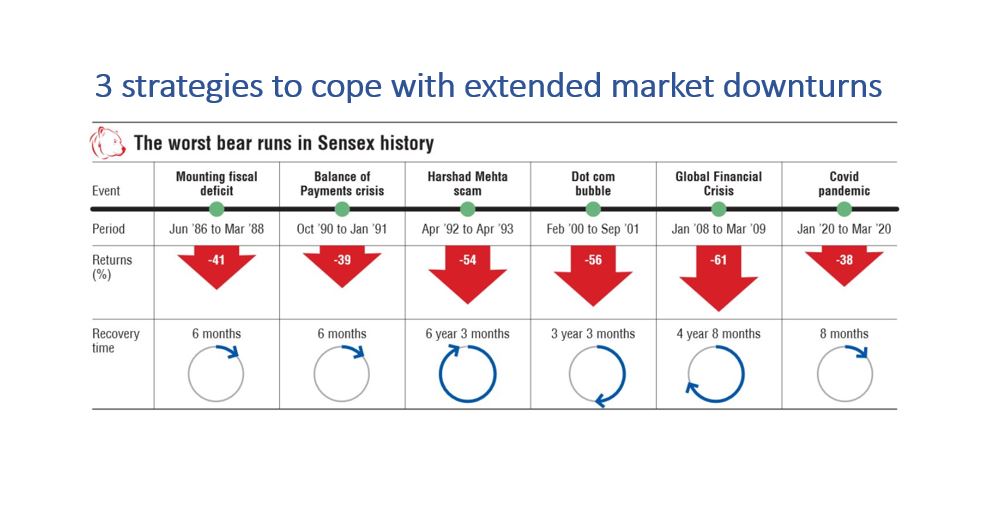

3 strategies to cope with extended downturns

Key takeaways The longest bear market in India seems to have lasted a little over 6 years However, there are periods even as long as 12 years where the markets were in practice range bound Although this hasn’t happened…

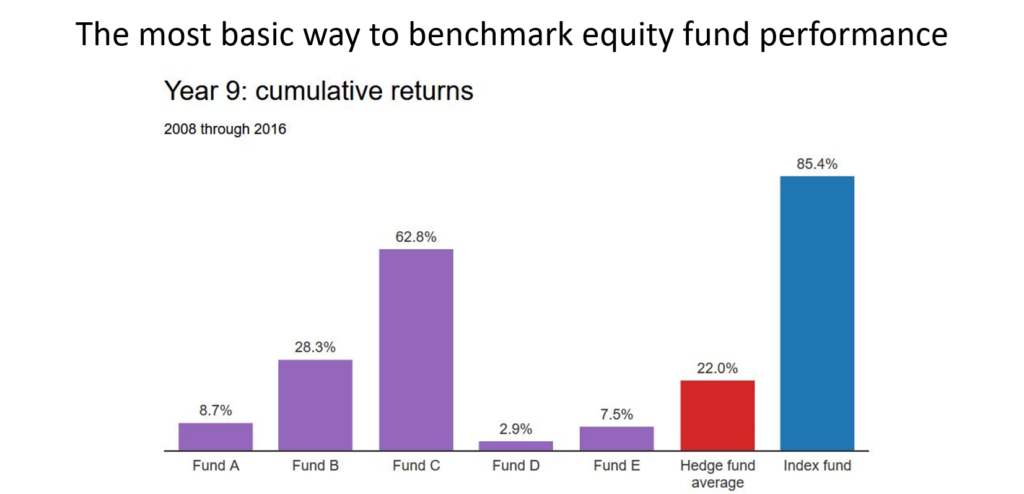

The most basic measure of equity Mutual fund performance

Key takeaways Investment performance measurement has a range of dimensions and angles One way to start measuring investment performance is to measure the overall historical returns at a portfolio level A next step could be to check whether you’ve managed…

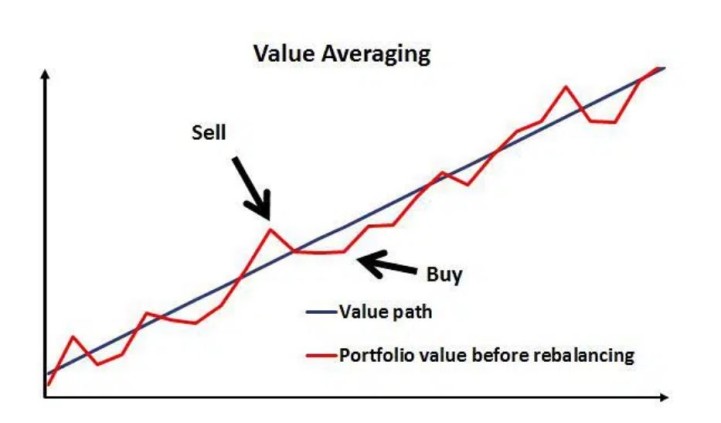

How to implement value averaging and profit from downturns

Key Takeaways: Value averaging is an investment strategy developed by Michael Edleson Michael is a Managing Director at Morgan Stanley. Earlier he was Chief Economist of NASDAQ & a finance professor at Harvard Business School. He has a PhD from…

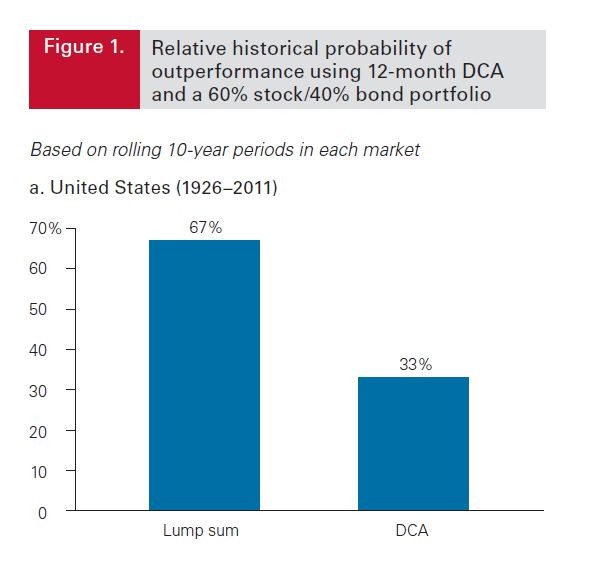

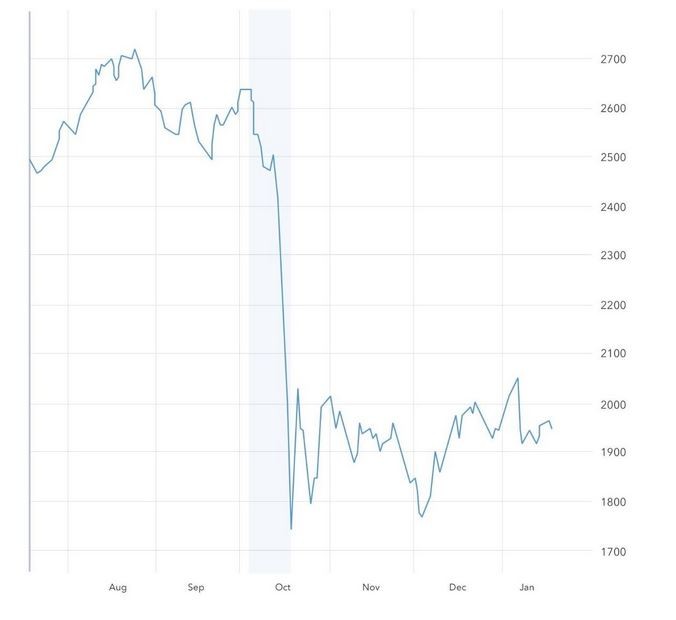

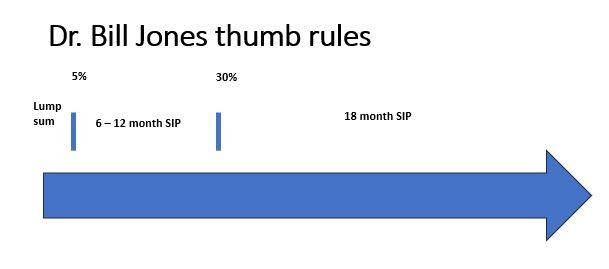

If you have a lump sum to invest, should you still do an SIP?: Data from Vanguard & DFA Studies

Key takeaways Getting this decision right is important because a crash after a lump sum investment could scare you away from the market forever thereby causing you to lose out on long term returns On the other hand, if you…

7 approaches to one of your most important investment decisions

Key takeaways Asset allocation is one of the very few things in your investment plan that you can actually control In most cases, the higher your allocation to stocks, the higher your portfolio returns will be But wise asset allocation…

Lump sum vs SIP decision: Asset allocation approach

Key takeaways Making the decision to invest a lump sum takes more than data A crash could occur the very next day after your SIP completes thereby putting in question the whole SIP approach So the key question to really…

Lump sum vs SIP decision basis existing investments

Key takeaways Looking at the lump sum available in comparison to the amount you have already invested in the market is yet another lens with which to make decisions If the amount you have available to invest is relatively small…

How to accurately measure returns of ALL your past & present Mutual Fund investments

Key takeaways The REAL historical overall returns of your portfolio is the equivalent of an exam report card But most tools provide returns on your CURRENT investments (i.e. funds with non zero balances) but miss accounting for all the funds…

Have your investments beaten inflation or will you have to cut back on lifestyle

Key takeaways Benchmarking your investment returns at a portfolio level against inflation is important because it enables you to know whether you will be able to continue a similar lifestyle in retirement or not The first step is to accurately…

Bogle on the surest route to picking a top quartile Mutual Fund

Key takeaways When looking to invest in an active mutual fund, I and many other investors tend to first look at a fund’s star rating or it’s past performance data. Both are not the right things to look at Whose…

Bogle says you shouldn’t use past AGGREGATE returns to pick funds

Key takeaways Bogle says there is no way to predict a fund’s future returns based on it’s past record Bogle says you CAN predict that a fund with high expenses will underperform the index Bogle says that you CAN predict…

Bogle’s s consistency criteria for selecting active mutual funds

Key takeaways The intuitive way to pick funds is based on past 3, 5, 7 or 10 year aggregate returns But research shows that strong past returns are not predictive of future returns One solution is to buy Index funds…

Dr. Bernstein on how to profit from market downturns

Key takeaways Dr. Bernstein is co-founder of Efficient Frontier Advisors, ($ 25Mn min investment) has authored over 10 books on investing and his insights are sought after by the world’s leading financial media Most people tend to panic &…

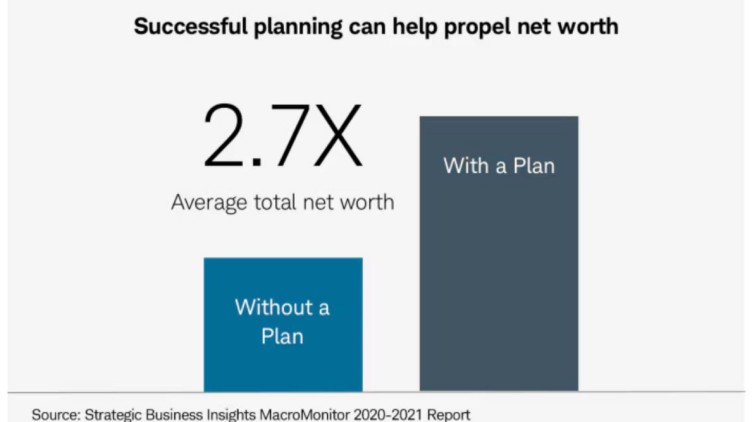

Simple steps to get to 2.7X net worth with an investment blueprint

Key takeaway An Investment Plan acts as a blueprint for financial success. An investment plan can boost net worth by 2.7 times For the simplest investment plan see Dilbert founder Scott Adams' take on this Step 1: Calculate required amount…

Buffett betting billions on Index fund investment

Key takeaway The choice to invest in active or passive funds is one of the top 5 most important investment decisions. The wrong decision on this could end up costing you heavily. Buffett’s advice to common investors in his 2004…

Value Averaging to generate at least 10% higher returns than SIP

Key takeaway This is, in my view, one of the best kept secrets of Investing Value averaging is a method like SIP and rebalancing done together Value Averaging is a method developed by Harvard Professor Michael E Edleson This method…

Harvard professor’s method to calculate monthly investment needed for retirement

Once you have your retirement figure calculated using the steps outlined in my earlier article, you need to work backwards from that and work out how much you need to invest each month to get to that final figure. In…

Based on my net worth today can I safely retire? If not, how much do I need?

Who all might find this article useful If you think you fall into any one of the following categories, this article could well be relevant and useful for you People approaching retirement: If you have been thinking about retirement lately…

Where to invest so you don’t have to cut back on lifestyle in retirement

Key takeaways Retirement is typically a 30 to 40 year period Prices can increase very significantly (12 times or even much more) over such a long period This is Inflation. Equity / investments in the Indian stock market have over…

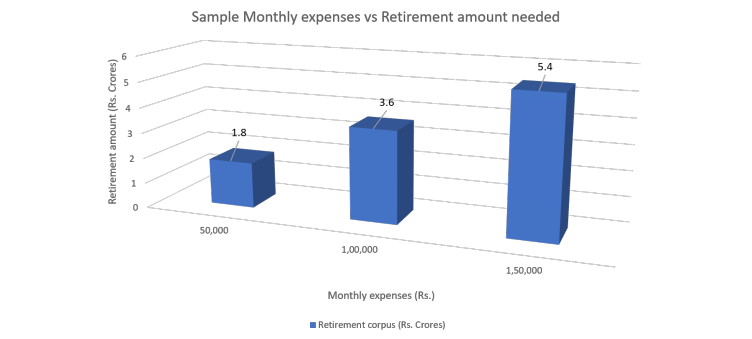

Simple steps to calculate how much you need to be able to retire

In my earlier article, I demonstrated a simple way to do a dipstick calculation to validate whether one has sufficient funds to retire TODAY. For most folks however, the answer is likely to be that we don’t have sufficient just…

Avoid errors amounting to several crores in retirement planning with this due diligence

Summary & key takeaways An error of under 2% in the expense inflation figure assumed in retirement planning calculation could result in a whopping 10 crore error over a 25 year period This is why it’s critical that one assumes…