Key takeaways

- The longest bear market in India seems to have lasted a little over 6 years

- However, there are periods even as long as 12 years where the markets were in practice range bound

- Although this hasn’t happened in India yet, if one looks to data across countries around the world, the longest downturns have lasted 34 years and more in some cases.

- While nearly nothing can enable one to tackle a market downturn that lasts between 30 & 50 years, in general, one can take some actions to cushion the blow of more normal bear markets.

- Here are 3 possible ways to reduce the impact of long market downturns

a) Include another country or countries in your portfolio

b) Have sufficient bonds to last through the longest bear market

c) Employ Value averaging or SIP rather than Lumpsum investments

Although I am normally optimistic and believe that market downturns are great opportunities as they are often followed by significant upswings, I think it is also important look at the other possibility as well i.e. a long & extended downturn and be well prepared for it

This article looks at some of the longest downturns we have had in India and 3 approaches to cushion the blow should there be such an extended downturn

India’s worst bear markets

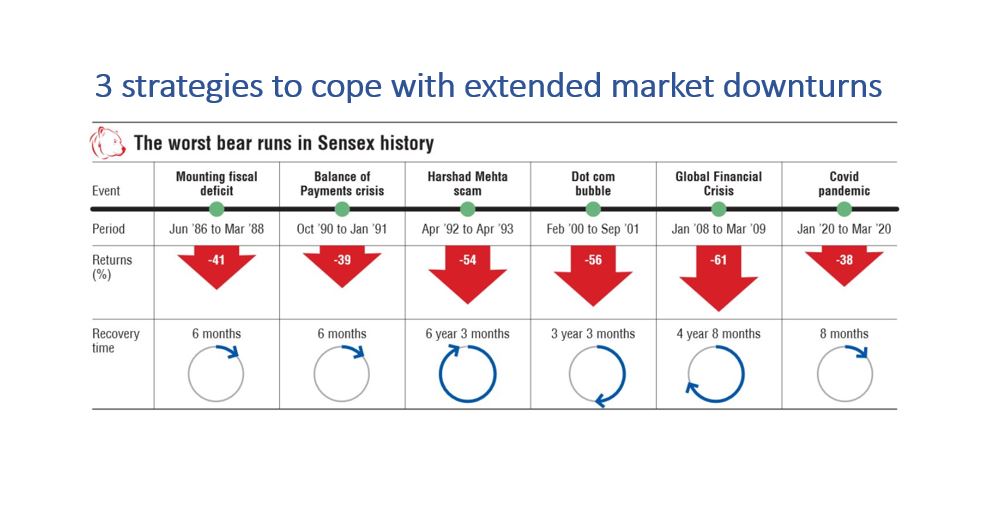

To prepare for an extended market downturn, it’s important to look at some historical data to get a feel for how long previous downturns have been

As you can see from the above data from Valueresearch, India’s longest bear market lasted a little more than 6 years. So if historical data is anything to go by, it would be prudent to have a strategy that braces you to weather a 6 to 7 year bear market

Cautionary note: Despite the fact that 6 years is “technically” the longest recovery period, in practice there has been at least one period of nearly 12 years (from March 1992 to about March 2004) where markets haven’t “really” recovered. The graph below from Valueresearch shows the path of the Sensex from March 1992 until March 2004. Notice that although the Sensex “technically” recovered it’s level within a few years, it did so only momentarily a couple of times but otherwise was range bound between 3000 & 4500 for nearly 12 years.

Below are 3 defensive strategies to deal with long bear markets. While none of them can be considered a guaranteed way to manage or tide over bear markets they can help reduce the impact or cushion the blow. See which of them make sense to you or resonate with you in some way & make your choice. One could consider them either separately or together.

1. Global diversification

In an idealistic scenario, the hope is that while stocks in India are down, stocks in another country are doing well. Look at the year 2023 in the chart above from Valueresearch. While the Nifty 50 was giving negative returns, US stocks were giving positive returns. Conversely, for the year 2022, while US stocks gave negative returns, India stocks (Nifty 50) gave positive returns. Of course, given how incredibly interconnected the world is, that idealistic scenario doesn’t play out very often.

So in reality, adding another country’s stocks to your portfolio at least reduces the impact of long bear markets. Notice from the graph below how a portfolio with 25% US equity exposure has reduced the impact during meltdowns.

2. Sufficient bonds to outrun the longest bear market

The concept here is to make sure you have enough funds allocated to bonds / non-volatile investments so that you don’t have to sell any stocks / equity investments through the longest conceivable downturn in the stock market.

Let’s see how this works with a simple example. Let’s assume your monthly expenses are Rs. 1 lakh. So your annual expense is 12 lakhs.

Now we know that the longest bear market in India was during the Harshad Mehta scam & that at that time the market took a little more than 6 years for recovery. But let’s say we play it extra safe & assume the worst case 12 year recovery time above.

If we don’t want to have to sell stocks at a loss during the long bear phase, we need to have a sufficient amount in bonds so we can keep spending from there during the long bear phase.

In the above example, we would need to have a MINIMUM of 12 X 12 = 1.44 Crores in bonds & can put the rest into stocks

So the action item here is to review your asset allocation & check to make sure you have enough in non-volatile debt like assets to make sure you can last through the longest bear market in history that your country has seen.

Credits due to Darrow Kirkpatrik for bringing this approach to my attention

3. Value averaging or SIP. No lump sum investments

You might want to consider avoiding lump sum investments to reduce the possibility of massive losses after catching a market high followed by a long drawn out bear market.

See the following chart from Valueresearch to see how an SIP performed better than a lump sum during the 2008 financial crisis. This shows that an initial 12 lakh lump sum investment (grey line) would have grown to 10.6 lakhs while an SIP (blue line) would have grown to 16.39 lakhs

An oft quoted but extreme example of this is the Japanese stock market that had a 34 year long bear market. Those that invested at the peak of the market around 1989 would have lost approx.. 73% even after 20 years.

So how do we defend against such extreme loss scenarios? If you are doing a plain vanilla SIP through a bear market that should work rather well. See the chart below that shows what a one dollar per day SIP would have resulted in, even in one of the worst bear markets in the history of the world like Japan from 1990 to 2024.

If, on the other hand, you like Dr. William Bernstein’s recommendations of course you could do the more sophisticated Value Averaging approach in the hope of buying more than an SIP during bear markets

One last tip: Although there are no rules of thumb, just keeping an eye on valuation metrics like PE & PB values at all times when investing in stocks can help. For example, PE levels were in the 90s as Japan approached it’s peak. Most investors keeping an eye on the market valuations in the years running up to PE levels of 90 could have constantly reduced stock allocations as the peak of the Japan market approached.

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I’ve invested in Mutual funds for approx. 24 years. I’ve also been a diligent student of the subject of investing over the past 24 years learning & applying the writings of luminaries in the field. In these articles I’m merely sharing my experience & learning from that investing journey and the books of luminaries in the field in the hope that it might help others in some way. Neither am I in any way directly or indirectly claiming to be a hot shot investor who has generated exceptional or even above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes, educate yourself on sound investment principles & develop good financial habits you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments. I shall not be liable.