Summary & key takeaways

- An error of under 2% in the expense inflation figure assumed in retirement planning calculation could result in a whopping 10 crore error over a 25 year period

- This is why it’s critical that one assumes as accurate as possible an inflation figure in one’s retirement planning calculations

- While there are various publicly available measures of Inflation like the Consumer Price Index (CPI) and the Wholesale Price Index (WPI), what we really need to focus on is track the rate at which OUR personal family expenses are growing each year.

- The CPI and other indices assume a certain typical weightage of spend on various categories. However, each family has a different spending pattern. Hence the CPI etc. are not good indices of inflation to base our retirement planning assumptions on.

- Summary of action steps one needs to take to get the right inflation figure:

- a. Track your family’s expenses monthly

- b. At the very least, split your expenses into 2 categories: a) Essentials or needs that you simply cannot live without and b) Non essentials i.e. wants, Desires, luxuries etc.

- c. After you have about 3 to 5 years worth of annual expense data, track the rate at which your essential expenses have grown. Use this figure in your expense inflation calculations

Example of retirement investment inflation error: 10 crores over 25 year period

If you’re about to make an investment plan for a goal like retirement, one very key and critical component of the plan Is the inflation number you factor into your investment plan. This is critical because the longer the time horizon for the goal, such as say a 25 year goal for retirement, the margin of error grows rapidly. Let me illustrate.

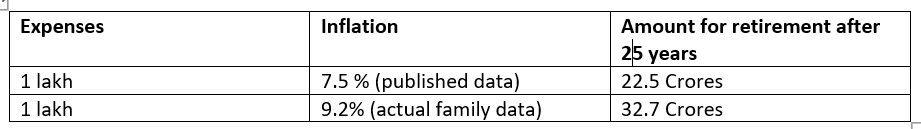

If you’re planning for retirement and let’s say your monthly household expenses are Rs. 1 lakh currently. If you assume a historically published rate of inflation of say 7.5%, and retirement is 25 years away, then using the 4 percent rule explained in my article here you would arrive at a retirement corpus of approx. Rs 22.5 crores. As an example however, let us assume that a family’s actual expenses increase at a rate of 9.2 % per annum – only 1.7% higher than the public published inflation figure Then, with actual inflation at that value the retirement corpus needed would move up to a whopping 32.7 crores ! That’s a ten crore difference and a nearly 50% error in the calculated value !

Inflation is a very real challenge and has to be factored into anyone’s investment plan. If you’d like a few specific illustrations of what inflation does to prices over long periods of time and how to combat it, have a look at my article on this here.

Why publicly published inflation figures could be very misleading

The term “inflation” generally refers to the rate at which prices of goods & services are increasing and governments have various measures of Inflation like the Consumer Price Index (CPI) and the Wholesale Price Index, (WPI). However it could prove very dangerous to plug these figures into one’s own retirement planning calculations.

The reason that we should not use publicly available inflation data for our inflation calculations is as follows: The CPI & WPI are a pre-set combination of goods & services with a particular weightage. For example the CPI has the following components & weights:

- Food and Beverage – 45.86;

- Housing – 10.07;

- Fuel and Light – 6.84;

- Clothing and Footwear – 6.53;

- Pan, tobacco, and intoxicants – 2.38;

- Miscellaneous – 28.32;

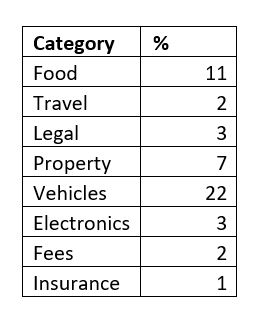

But this standard component split & weightage may not be remotely applicable to us and our family’s spending habits and way of life at all. For example, some families spend heavily on any one or more of the following types of items: Eating out at restaurants, vacations, electronic gadgets, jewellery, clothes, fancy bikes, cars etc. etc. As an example, the percentage of expenses spent by a family could split up something like this:

As you can see from the above table, the actual weightage of expense of this family have very little correlation or similarity with the constituents of the CPI above.

The solution to getting the right inflation figure

So the best thing for you to do is to diligently track your family’s expenses year after year. In addition, as Pattu from Freefincal very astutely points out, you could also split your annual expenses into 2 categories: essential and non-essential expenses (needs and desires) and track the rate of increase of your essential expenses separately and use that figure in your retirement calculations. Note that you probably need 3 to 5 years worth of tracking your own expenses before you can come to a fairly accurate rate of increase of expenses. But don’t let that deter you: Just start with the first year’s expense increase figure and keep updating that figure each year as you go along.

I have to thank Bill Schultheis, the founder of the world famous Coffee House Portfolio for shining a light for me on this incredibly simple yet common sense approach on what inflation figure to use.

Recap of action items:

- Track your family’s expenses monthly

- At the very least, split your expenses into 2 categories: a) Essentials or needs that you simply cannot live without and b) Non essentials i.e. wants, Desires, luxuries etc.

- After you have about 3 to 5 years worth of annual expense data, track the rate at which your essential expenses have grown.

- Use the figure from step 3 above in your expense inflation calculations