Who all might find this article useful

If you think you fall into any one of the following categories, this article could well be relevant and useful for you

- People approaching retirement: If you have been thinking about retirement lately and the financial angle of retirement planning has come up for you, then this article could be useful.

- People with abundant current cashflow: On the other hand, if there’s an abundance of cashflow currently in your life and you feel like retirement isn’t something you really need to plan for or worry about, well even in that scenario this article could help as a checkpoint to validate your assumption.

- Young professionals: who believe it’s way too early to plan for retirement

Here’s the simple question that we’ll try to answer with this article: Based on my net worth today can I safely retire or not? If the answer is yes, Great ! start making plans for what you want to do in retirement ! If the answer is that you don’t have enough invested yet to retire, you’ll get a quick way to calculate how much you will need in the future to be able to retire safely. Then in my subsequent article we’ll look at how to make an investment plan to reach for the corpus you need in order to retire.

And why retire? Well, my simple answer would be to increase your freedom, time, options and choices in life. More on how to discover your personal why for investing in my earlier articles here and here.

Summary

- The basis of this article and the calculations are the world famous 4% rule developed by William Bengen

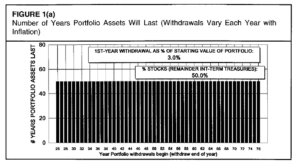

- Analysing 50 years of US stock & bond market data, Bengen concluded that if you have investments worth 25 times your annual expenses in the first year of retirement, it would last you at least 30 years.

- Bengen’s analysis also showed that if you had investments worth 33 times your annual expenses, then your investments would last 50 years. Useful info for those wanting to retire in their forties.

- Bengen used allocations ranging from 50 to 75% in equity mutual funds such as Large Cap Index funds and the rest in government bonds of 5 to 10 year maturity.

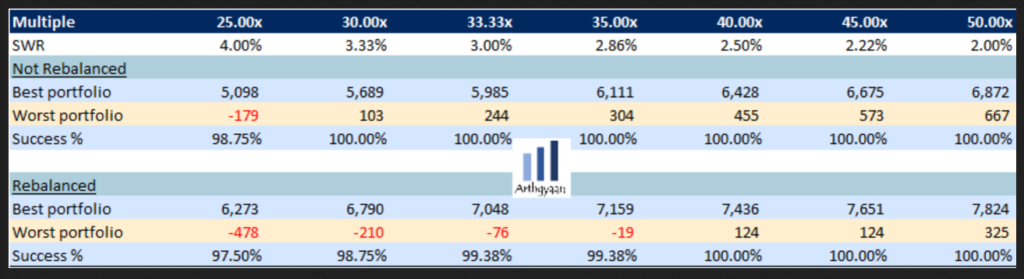

- Arthgyaan did a similar analysis based on Indian stock & bond market data and concluded that you need at least 30 times annual expenses

- Arthgyaan used a portfolio of 60% equity in an Index like the Sensex for the stock portion and the PPF rate for the debt portion

- Conclusion: Since data for India is relatively limited, you might be better off being more cautious and conservative and consider a figure slightly higher than 30 times annual expenses as per what you think is safe for you

What is the 4% rule?

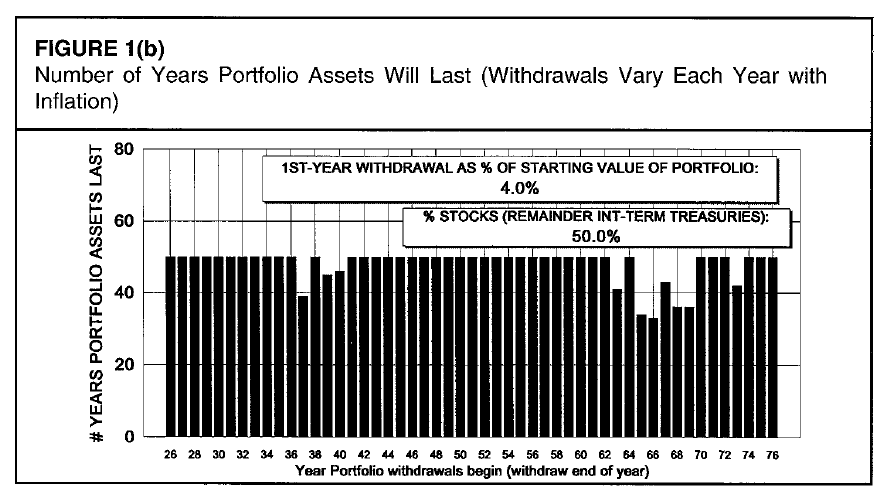

To arrive at our final retirement corpus, we multiply the projected annual expense in the first year of our retirement by 25. In summary, Bengen did detailed analysis based on actual stock market data in the US from 1926 until 1976 and found that if your expenses in the first year of your retirement are 4% of your investment corpus or less, then your investment income would last a minimum of 30 years. The four percent rule goes on to say that in subsequent years you can continue to increase your withdrawal rate at the prevailing rate of inflation.

The graph below from Bengen’s original paper shows how many years a retiree’s money lasted (on the Y Axis) based on the year they retired (X Axis)

The original paper published by Bengen can be found here

Is the 4% rule valid for India?

This is clearly a very valid question since the data that formed the basis of the 4% rule was US stock and bond market data. There is excellent research done by Arthgyaan on this topic and that’s published in this article of theirs.

In summary, it shows that withdrawals of 3.33% and lower work for India rather than the 4% rule.

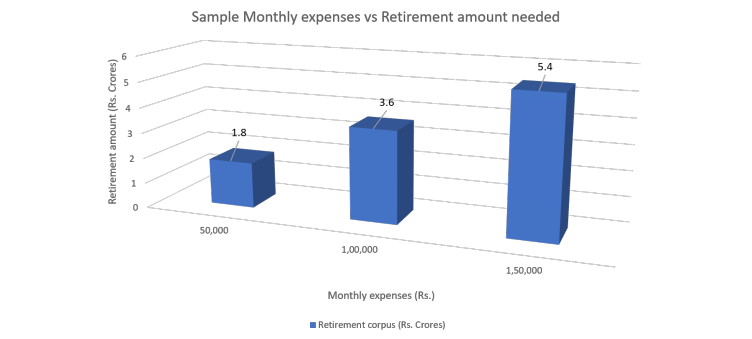

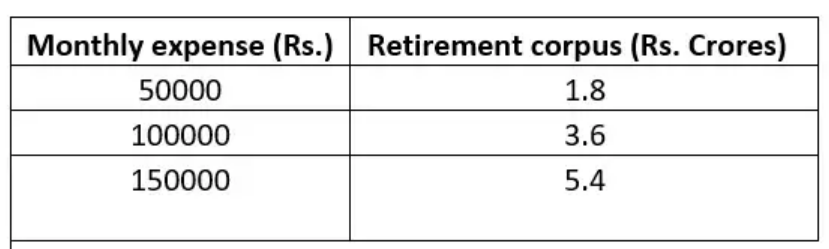

Typical figures for early retirement considering India data

So here are a few sample numbers based on the 3.33% rule for India data to help you get a feel for what kind of corpus one needs:

Portfolio composition needed for the 4% Rule to work

The starting point is to have a clear number or value of total investment needed to retire. But once that’s done, it’s important to note that the 4% rule works only when the investments are split in a certain allocation range and type of investments. So here are those details.

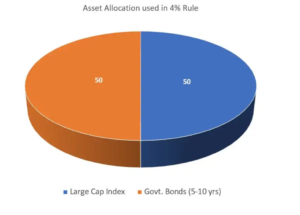

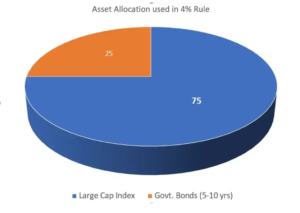

Here are the 3 other key points with regard to the makeup of the investment portfolio that was used when Bengen did the analysis & research to come up with the “Four percent rule”:

- You need to have between 50% & 75% of your investments in equity i.e. the stock market

- For the equity portion, it assumed that your investments were in Large Cap Indexed mutual funds. He considered the S&P 500 Index in the US. The S&P 500 in the US covers about 75% of the total market capitalization. So a close equivalent of that in India would likely be the Nifty 100

- The bond portion was in Intermediate term Government Treasuries i.e. Government bonds of duration 5 to 10 years e.g. RBI Bonds or National Savings Certificates (NSCs)

An additional data point for those interested in early retirement

For those of you considering early retirement or a second career while in your forties or early fifties, here’s another interesting data point from Bengen’s analysis: (see graph below) It showed that a withdrawal rate of 3% would last 50 years. So for those of you considering retiring early, it’s the “Three percent rule” and not the “Four percent rule”

In simple terms, this means that those that want to retire in their forties should have 33 times their annual expenses invested. Keep in mind though that you need to adjust this for Indian data.

In simple terms, this means that those that want to retire in their forties should have 33 times their annual expenses invested. Keep in mind though that you need to adjust this for Indian data.

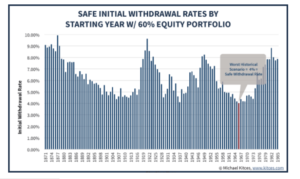

Further extensive analysis (US Data) confirming the validity of the 4% rule

For those of you who are still skeptical of the 4% rule given that his data analysis only covered 50 years of data and only until 1976, here’s some more data.

For those of you who are still skeptical of the 4% rule given that his data analysis only covered 50 years of data and only until 1976, here’s some more data.

In fact, Kitces’ data analysis (see chart below) showed that there was only 1 year of retirement (1966) where a 4% withdrawal rate was required. In all other years from 1871 to 1985 higher withdrawal rates were possible.

If you’d really like to dig into the details of the “Four percent rule”, here’s the first video in a series of deep dive videos on this topic by Rob Berger: Full credits for this article of mine are due to Rob Berger for his exceptional work in doing a deep dive on the 4% rule and explaining it in such a simple and clear manner.

Disclaimer1: I am not a financial advisor. Just a person who has invested in Mutual Funds in India for the past 22 years and sharing my experience, mistakes & learning from that journey in the hope that it will benefit others in some way. Please consult a financial expert or advisor before taking any decision or action with regard to your investments or savings.

Disclaimer 2: Most topics in personal finance & investing are subjective. There are very few things, if , any, that are truly either perfectly right or perfectly wrong. There is no ONE right answer in this area either. Everything is a shade of grey, an approach, a philosophy or a way of thinking about one aspect of investing. This topic & article is no different. The approach presented here is based on significant data analysis by other organizations and is just one way of arriving at a reasonable figure needed for retirement that has a high probability of seeing you through your retirement years. This article does not give you a ready made answer. It merely presents a set of data and analysis and an approach to arriving at a figure. You could consider multiple approaches including this one, and then make the final decision based on the data presented here or choose another approach that works for you.