Key takeaways

- Looking at the lump sum available in comparison to the amount you have already invested in the market is yet another lens with which to make decisions

- If the amount you have available to invest is relatively small compared to what you have already invested, a lump sum investment may well seem fine to you. If it’s the other way around, it may not

- The thumb rules presented here are based on Bill Jones’ research and recommended by Dr. William Bernstein

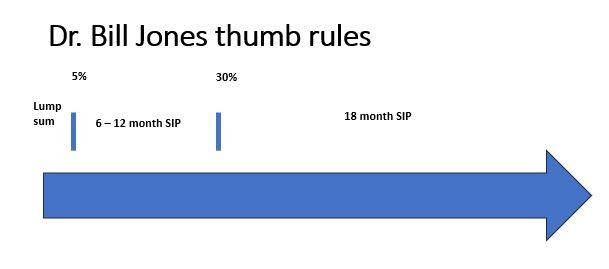

- If the lump sum amount available to invest is less than 5% of your existing equity investments, invest it as a lump sum

- If the lump sum amount available to invest is 5% – 30% of your existing equity investments then do an SIP over 6 to 12 months

- If the lump sum amount available to invest is more than 30% of your existing equity investments then do an SIP of 18 months

- Never forget however, that in the past, markets such as Germany, France & Japan have taken over 50 years to recover

- If a lump sum investment still irks you, you could consider using the the Value Averaging approach instead of an SIP

In my first article dealing with the Lump sum vs SIP dilemma, we saw data & research from studies done by Vanguard and Dimensional Fund Advisors. In my second article on this topic, we looked at asset allocation to address & answer this question.

In this article we review an approach that looks at how large the lump sum is compared with the amount you’ve already invested into equity. For this, I reference & quote strong research by Dr Bill Jones as recommended by Dr William Bernstein.

Let’s illustrate the basic concept here with 2 examples:

Example 1: Current equity investment 25 lakhs, lump sum 1 Crore

In the above example, the amount you have readily available as a lump sum far exceeds your current equity investments. At a current 25 lakh exposure you should mentally be prepared to take the risk of your equity investments falling to half their value overnight i.e. you should be prepared for a 12.5 lakh loss in value. However, if you were to add Rs 1 crore overnight to your equity investments, you would effectively need to be ready to accept a fall of yet another 50 lakhs in your investment value. That’s nearly a five fold or 500% increase in the quantum of loss you need to be ready to stomach. I figure most investors might have a hard time making this sudden shift of mindset.

Example 2: Current equity investment 1 crore, available lump sum 25 lakhs,

In this example I’ve swapped the 2 numbers as you can see. In this case, having 1 crore already invested in the equity markets, our investor is already in a position where he/ she needs to be ready to see a fall of 50 lakhs in portfolio value. (Refer to my article on asset allocation). So if he / she were to invest another 25 lakhs in one shot, he would only be needed to increase is ability to tolerate losses from 50 lakhs to 62.5 lakhs. That’s only a 25% increase in quantum of loss bearing ability. Hence in this case lump sum investing could easily be undertaken by most people.

Bill Jones’ thumb rule for Lump sum or SIP investing

Here’s a simple thumb rule laid out by Bill Jones & recommended by Dr William Bernstein:

When doing an SIP, if shifting 5% to 30% of assets into equity, do an SIP of 6 to 12 months. If shifting more than 30% of your assets do an 18 month SIP

If you’re interested in the details of Bill Jones’ research, here is his original article with all the data.

The key: Can you handle long term loss / fall in market value

Personally, I think that it all boils down finally to one question. Whatever amount I put into the stock market, can I stomach HAVING IT FALL IN VALUE BY 50% AND REMAIN AT THAT LEVEL FOR MANY DECADES BEFORE IT RECOVERS IN VALUE. Always remember that, in the past, stock markets in certain countries have fallen from their peaks and have taken 50+ years to recover. This is data as per the Credit Suisse Global Investment Returns Yearbook report

Still unsure or confused about Lump Sum or SIP? Try these options to break the deadlock !

Value averaging

Lastly, if you’re still not getting a good feeling about any of the approaches above, try the Value Averaging approach recommended by Investment Gurus like Dr William Bernstein. There ! If nothing else seems to work, that should do it ! Good luck !

Summary / conclusions of the Lump Sum vs SIP article series

The data & research from Vanguard and DFA seem to suggest that investing a lump sum may not be as risky as one thinks. The strongest case for investing a lump sum is that the market could fall the day after your SIP is completed.

Despite all that data suggesting Lump Sum investing isn’t that risky, it’s hard for many to invest a lump sum. So the key point to be addressed really is choosing the correct Asset allocation (% of safe investments like FDs / debt funds) as the key to safety rather than whether you invest a lump sum or do an SIP

Another perspective from which to look at this dilemma is to compare the amount you already have invested in the market to the amount you have available to invest currently and invest as per Bill Jones’ thumb rules above in this article.

If you’re still not feeling too comfortable with a lump sum investment, Value Averaging into one’s asset allocation over a period of 3 years or more might just be the solution for you to the above Lump sum vs SIP dilemma

The key to all of this is always asking yourself whether you can handle a 50% fall in the value of your equity investments and have it stay down for a loooong bear market of say 10 years or in the extreme even 50 years !

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I am merely someone like millions of other common folk who have been investing in Mutual Funds. I’ve invested in Mutual funds for approx. 22 years. I’ve also been a diligent student of the subject of investing over the past 22 years. In these articles I’m merely sharing my experience & learning from that journey in the hope that it might help others in some way. Neither am I in any way directly or indirectly claiming to be a hot shot investor who has generated exceptional or above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes and don’t repeat them, you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments.