Key takeaways

- More risk = More return & Less risk = Less return

- If a scheme promises high returns with low risk it’s most probably a scam

- When we see high returns we normally never seek to question them

- On the contrary, one should always be highly suspicious if one seems to be getting significantly higher returns than the benchmark Index or the category average

- I did this myself. Some debt funds were generating as much as 9%. I got carried away & invested more. It took over 3 years even to get just the principal back. This was probably the biggest investing mistake I made in the past 24 years.

- A friend recently told me he was making 24% on his investments. Such a high return raised a red flags me.

- The first thing to question is the period of returns measurement. It should be at least 10 years as per many luminaries in the field of investing

- The second thing to check is whether ALL past investments (i.e. those bought & sold) have also been included in the calculation or only current ones are being measured

- The third red flag is the level of risk being taken in terms of overall equity allocation as well as allocation to more volatile categories such as mid caps, small caps or sectors

The relationship between risk & returns

One of the most important things to keep in mind when investing is that risk & reward are opposite sides of the same coin. You can’t have one without also getting a fair share of the other 😊 More risk = More return & Less risk = Less return.

So if any scheme is promising you or actually generating significantly above average returns that’s usually a big red flag, Even without any details about the scheme, you can almost automatically assume that there’s also significantly higher risk involved. On the other hand, if a scheme promises high returns with low risk it’s most probably a scam.

Beware & be suspicious of unusually high investment returns

Since More risk = More return, the corollary should also apply i.e. if I see more returns in my investments I or the person investing on my behalf is likely taking more risk.

However, most of us want to be or feel like winners or achievers at anything we do in life. Investing is no exception. So when we see unusually high returns in one or more of our investments, our first instinct & our brain’s conclusion is that it is because of our being clever or smart about our investing in one way or another. But jumping to that conclusion in the domain of investing could well be a grave mistake.

Let’s just say in summary that if something sounds too good to be true, it probably is.

One of my biggest investing mistakes

The Franklin debt fund crisis was one of the biggest lessons for me & thousands of others across the country. While you can read more details about my experience on this in my article, here’s the summary: In general, a few Franklin Debt funds were giving returns of over 9%. I got elated looking at the numbers & invested quite a substantial amount into these mutual funds. After a while, the fund was frozen / shut down and it took me & thousands of investors across the country over 3 years to get most of our money back. I count this as the single biggest investment mistake I have made over the past 24 years of investing in mutual funds.

What was the cause? The fund manager was taking higher risks in the background that most of us as lay investors were oblivious of and when it came to light, investors started panic redemptions to such an extent that Franklin could not honor the massive & unexpected volume of redemption requests that came in. So in summary, the unusually high debt fund returns were due to high risk being taken in the background.

A friend says he’s making 24% returns

Recently I was speaking with a former colleague of my dad’s. He’s been investing in the stock market for decades. As background, he’s always been a high achiever in his career graduating from the top of his batch at college, getting some of the best high paying jobs & finally even going on to win awards at a national level. So I can see that it’s natural for him to want to feel like or believe that he’s at the top of the class when it comes to investing as well.

We got to talking for a few minutes about investing & he bragged that he was making 24% on his investments in the stock market.

To check if I was missing something, I checked the returns of the smallcap Index (since they would likely be assumed to be the kind of category that would generate some of the highest returns) and found that the smallcap index had only returned 14.6% over 10 years. So I concluded that even if my dad’s friend were invested ONLY in smallcap funds, (an EXTREMELY risky proposition indeed given the wild negative & positive swings in annual returns) it would be particularly hard for him to beat 16.04% (assuming he was quoting his aggregate returns over a 10 year period)

While I suppose it is entirely possible my dad’s friend really has made 24% returns over a short period of time, I would be extremely surprised if he or anyone had made that much consistently over a 10 year period or more. It is interesting to note that even Warren Buffett has only generated about 20% on average over the long term.

In all probability, I would conclude that my dad’s friend’s investment firm is doing one or more of the following:

- Taking on too much risk, or

- They are showing only his short term (less than 10 year) results or

- They are showing him only current returns & not including investments bought & sold in the past.

Consequently, here are the 3 things I would do to scrutinize seemingly high returns carefully:

3 things to investigate when you see unusually high returns

- Check what is the DURATION over which the returns have been generated. As you will see in this article from valueresearch, many funds and stocks can easily generate very high returns over the short term (e.g. 1 to 3 years). However, for the real mettle of an investment to be proven, as Bogle said, it’s performance needs to be sustained over a 10 year period. It’s with a 10 year period that the men get separated from the boys so to speak as Warren Buffett proved by winning a million dollar bet against fund managers.

- Question how the calculations were arrived at: check whether

- Returns being measured are only CURRENT returns or HISTORICAL returns including all investments bought & sold in the past and

- Check the integrity & trustworthiness of the software being used to report investment returns & preferably take a “second opinion” so to speak on your investment returns by importing your portfolio into a trustworthy software / tool. For investors in India, I have personally used tools like Valueresearch fund advisor & Kuvera.

You can learn how to measure your returns accurately using Kuvera & Valueresearch by referring to my articles here & here

- Check the level of RISK in the portfolio

- Check what percentage of your funds are in equity vs debt

- Check what percentage are in Large cap, mid cap & small cap

- Check what percentage of your funds are in Sector / Thematic funds

You can get all the above data & inputs by creating an account on valueresearch and then importing your investments into valueresearch.

How to know what qualifies as a significantly above average return?

To get a feel for whether the returns you are getting on your investments are significantly higher than average, just compare it with what the corresponding benchmark Index is generating and / or compare it with what the category average is

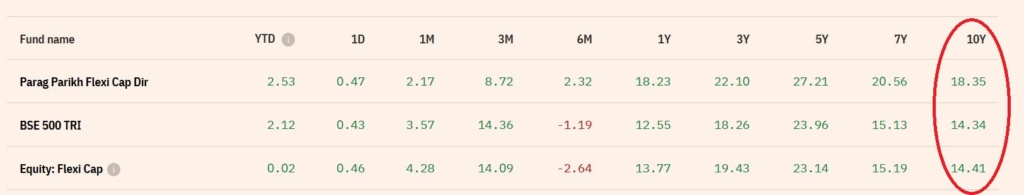

See the image below as an example. In this case, the fund has beaten the benchmark Index (BSE 500 TRI) and the category average handsomely over even a 10 year period. Hence, this fund would NOT be a cause for concern.

However, with many other funds, you might find their 1 or 3 year returns beating the Index or category (short term high performance by taking risk) while the 5, 7 or 10 year returns will likely lag the same.

You can get the above data for each of your funds by following these steps:

- Go to valueresearchonline.com

- Click on the “Funds” tab on the top of the page

- Search for the fund you’re invested in

- Click on the “Returns” tab

Now compare the fund’s returns (first row) over 5 to 10 years against it’s benchmark which is in the 2nd row below the fund’s returns.

You can also compare the fund’s returns (first row) over 5 to 10 years against the category average in the 3rd row.

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I’ve invested in Mutual funds for approx. 24 years. I’ve also been a diligent student of the subject of investing over the past 24 years learning & applying the writings of luminaries in the field. In these articles I’m merely sharing my experience & learning from that investing journey and the books of luminaries in the field in the hope that it might help others in some way. I am in no way directly or indirectly claiming to be a hot shot investor who has generated exceptional or even above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes, educate yourself on sound investment principles & develop good financial habits you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments. I shall not be liable.