Key takeaways

- This article focuses on the current US market, however, by getting relevant valuation data, a similar approach could be used for any market like India or asset class

- While the current CAPE ratio of the S&P500 (approx.40) isn’t as high as it was during the dot come bubble (approx.. 45), it is rather close

- When valuations are high, future returns are relatively low

- For the current CAPE ratio of 40 future predicted returns as per research are around 3%

- Dr. Bernstein recommends changing allocation by anywhere between one fifth & one tenth of the percentage increase or decrease in valuations

- As an example if markets are 100% above their median then one would reduce their allocation by anywhere between 10 to 20% – ideally closer to 10% for a bubble per Bernstein

- Dynamic asset allocation is a tricky area of investing to get into. So venture into it only if you feel very strongly about it.

- Read all notes of caution & disclaimer at the end of this article before taking any action in line with this topic

This article focuses on the current US market, however however, by getting relevant valuation data, a similar approach could be used for any market like India or asset class. Let me start with a disclaimer. I’m no one to be able to say definitively whether or not there is a bubble in the US or when it will burst. I haven’t the foggiest idea about any of that. However, it does seem prudent to me to keep an eye on valuations & make minor adjustments to lower one’s equity allocation as valuations continue to get stretched upwards.

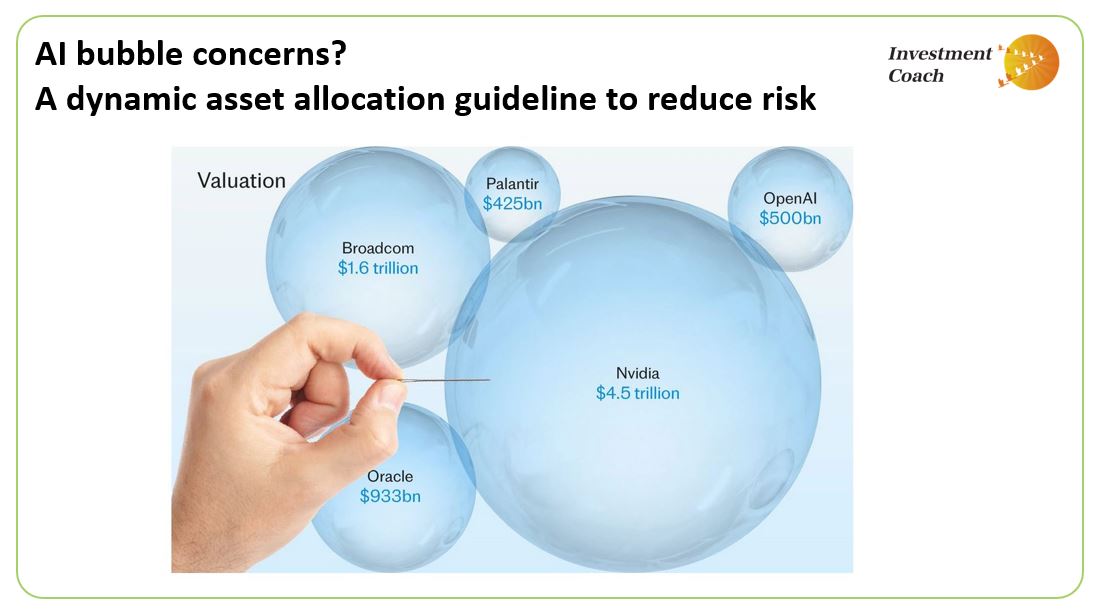

Why consider de-risking US equity investments?

If one is honest with oneself, being human, most of us are likely to feel some level of anxiety as we see markets rise seemingly without limit & at a rapid pace. Why? Because anyone who’s been investing in equity for a while knows that stocks can come crashing down like a pack of cards without warning. Alternately, even if the scenario doesn’t play out in as extreme a manner by way of a crash, data shows that returns of an overvalued asset class tend to be relatively low going forward.

So being able to make modest and sensible adjustments downwards for any portion of your equity portfolio that’s relatively overvalued could help reduce the risk. Think of it as doing a bit more than just “re-balancing” your portfolio.

Stretched Valuations?

One of the key measures of valuations in the US is the CAPE Ratio. To help you decide whether or not valuations are high relatively speaking, below is a chart showing the CAPE ratio from the 1980s until now.

You can see from the chart below that although the CAPE ratio is not yet at the 2000 dot com bubble high, it is pretty close.

Future returns

Below is yet another chart that shows future 10 year returns for developed markets based on the starting CAPE ratio. As you can see for a starting CAPE ratio of 40, future 10-year returns are just around 3% !

Who is Dr. Bernstein & what are his guidelines for dynamically changing your asset allocation?

Dr. William Bernstein, co-founded investment firm Efficient Frontier Advisors. To be able to engage his firm, one needs a minimum investment of $25 Million. For those of us who don’t have $25 million, he has written over 10 books on the subject of personal finance & investing. 😊 He is also frequently interviewed by media houses such as CNBC. His insights have been featured in major financial publications such as The Wall Street Journal, Morningstar, and the Financial Times.

In his book, The Four Pillars of Investing Dr. Bernstein says “You should increase your stock allocation only by very small amounts – say by 5% after a fall of 25% in prices – so as to avoid running out of cash and risking complete demoralization in the event of a 1930s style bear market.” i.e. you increase your allocation by one fifth (or 20%) of the extent of the fall

Variation in thumb rule for selling during market highs

When I asked Dr. Bernstein about this a while back, he said he still believed the thumb rule applied. The only variation he suggested was that he would rather use a more conservative 1:10 ratio (rather than the 1:5 ratio during a downturn) if one is selling during a market bubble.

An example with calculations to explain

Initial allocation: 70% equity / 30% debt. We shall assume that the investor is comfortable with (and has the needed risk tolerance for) 70% equity & 30% debt in his portfolio.

Current Valuation: We shall assume merely for the sake of illustrating by way of an example, that the median CAPE ratio is 20 and today it stands at 40 i.e. 100% above historical median

Calculation: Upper end guideline

If you were to use Dr. Bernstein’s “1% for every 5%” adjustment guideline, here’s how one would calculate the delta change needed.

One fifth of the extent of the rise of the markets above the median (i.e. 100%) is 20%

So the investor should be decreasing their equity allocation by 20% of 70% (initial / current equity allocation of the investor) i.e. by 14% down from 70% to 56%

Calculation: Lower end guideline

On the other hand, if you were to use Dr. Bernstein’s “1% for every 10%” adjustment guideline, here’s how one would calculate the delta change needed.

One tenth of the extent of the rise of the markets above the median (i.e. 100%) is 10%

So the investor should be decreasing their equity allocation by 10% of 70% (initial / current equity allocation of the investor) i.e. by 7% down from 70% to 63%

For a bubble Dr. Bernstein’s recommendation leans more towards the ”1% for every 10%” adjustment. Clearly the final judgement call is yours but, in the example above, if you chose to decrease your asset allocation from 70% down to anything between 63% to 56% you would probably be alright.

Another approach to consider

If you haven’t yet reached your target equity allocation, and are still building up an equity position to reach your target, then the Value averaging technique helps you do this almost automatically.

A few notes of caution on dynamic asset allocation

Dr. Bernstein suggests these ONLY as a general and a very high level GUIDELINE to give us some kind of “ball park feel” for how much to increase or decrease one’s allocation by, not necessarily as a RULE or perfect formula to be followed accurately. One needs to use his guideline & then make a judgement call on one’s own as to what change of percentage feels right.

Assessing historical valuations can be particularly challenging for a variety of reasons. Hence, dynamic asset allocation in general is a very tricky area of investing to venture into. Most people will probably be better off staying away from it and just doing plain vanilla re-balancing.

However, many high achievers are typically action oriented and find it hard to sit still and do nothing when valuations “seem” (because no one really knows for sure) to go very high or very low. If you’re such a person, well, then these guidelines give you some clear action to take and a range within which you will likely not end up doing anything arbitrary or dangerous to your portfolio.

If anything in the above guideline / example wasn’t clear, or you’d like my help to calculate how much to reduce your own allocation by, feel free to email me on mezjan@investmentcoach.co.in

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I’ve invested in Mutual funds for approx. 24 years. I’ve also been a diligent student of the subject of investing over the past 24 years learning & applying the writings of luminaries in the field. In these articles I’m merely sharing my experience & learning from that investing journey and the books of luminaries in the field in the hope that it might help others in some way. I am in no way directly or indirectly claiming to be a hot shot investor who has generated exceptional or even above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes, educate yourself on sound investment principles & develop good financial habits you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments. I shall not be liable.

Credits: Dr William Bernstein, Ben Felix