Key takeaways

- Bogle says there is no way to predict a fund’s future returns based on it’s past record

- Bogle says you CAN predict that a fund with high expenses will underperform the index

- Bogle says that you CAN predict that funds that have done remarkably better than the Index will underperform in future

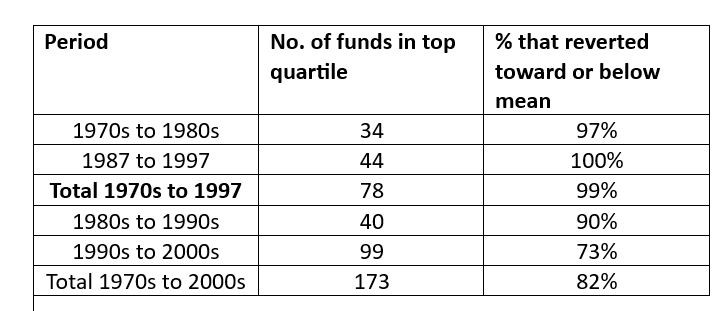

- US data shows that over a 40 year period, 82% of top quartile funds reverted downwards toward or below the market mean

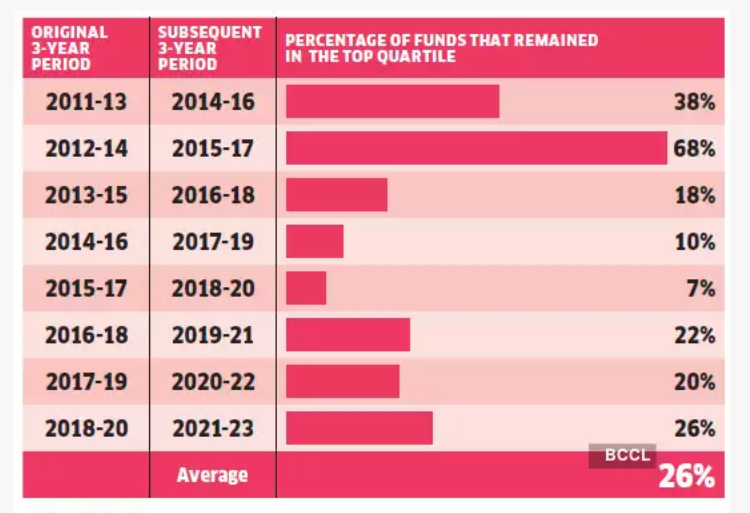

- Data from Indian mutual funds suggests that based on 3 year data only 26% (one in 4 funds) of top quartile funds remain in the top quartile

- When followed closely, some top ranked funds in India moved to ranks as low as 190 in the following 3 year period

- Analysis done by Arthgyaan shows that if you picked the top performing fund using past 3 year data, it consistently lagged that year’s current top performing fund by a wide margin (on average 15.07% vs 36% )

- Of the actively managed funds I personally bought, 17 of 25 funds gave lower returns than the corresponding Index. This is why I now follow Buffett’s advice to invest in Index funds instead

- Another significant problem when you choose to pick actively managed funds is that you pay taxes every time you switch funds and that causes a significant drain on your returns

- This is why, if you invest in active funds it is extremely important to be able to calculate what is known as “all-time returns” for your investments

The intuitive & seemingly logical way to pick a mutual fund

It’s natural, intuitive and almost seems like a no-brainer to review a fund’s past performance and then pick a fund with the best past track record. This is particularly true for people with a scientific, analytical or numbers bent of mind. I did that myself for many years.

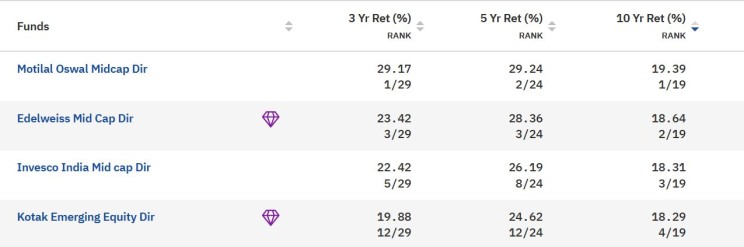

So let’s say I wanted to pick a mid-cap fund. I would go to Valueresearchonine.com, select the mid-cap category of funds and sort them by say their past 10 year returns, and then pick any of the top 3 funds based on past 10 year returns and maybe a few other criteria like fund manager longevity etc.

But Bogle says that’s not the way to pick active mutual funds.

Learning from others' mistakes

They say that all one does is avoid the mistakes others have made and learn from them, one can go quite far. Well this is one of those mistakes that I made for many years and millions of other investors continue to make. If you learn from our mistake and don’t repeat it, you will not only earn higher returns but most importantly, you will keep you investing life simpler, less busy, less cluttered and have more time to pursue whatever is most important to you in life

Bogle’s views

John Bogle was founder of the Vanguard Group, one of the largest investment firms in the world. Vanguard has over 9.3 trillion dollars in assets under management.

Common Sense on Mutual Funds is a book Bogle wrote on investing that has since become a classic for investors worldwide and is a book recommended to most investors by Warren Buffett

On the topic of using a fund’s past performance to pick a mutual fund, Bogle says: “There is no way under the sun to forecast a fund’s future absolute returns based on it’s past record”. Bogle further goes on to say that: “There remains no evidence – none – that superior past performance is predictive of future success”

Bogle, however, goes on to say that 2 things indeed CAN be predicted based on the past performance of a fund:

1. Funds with high expenses will underperform appropriate market indices***

2. Funds that have done much better than the indices will regress toward & usually below the market mean over time

In simple terms, it’s like the law of gravity. What goes up must eventually come down.

Here’s some data from the analysis of US funds: (Data on funds in India over 2 decades has been hard to get so we often get forced to use US fund data for longer periods of time)

Does this apply to the Indian equity markets?

Here’s an article in the Economic Times that bears out the fact that the same principles apply even in the Indian market. A few snippets and charts from the above Economic Times article below:

I quote from the above ET article: “It is impossible for a fund to remain a top performer across market cycles. Data from FundsIndia shows that only one out of four top performing funds over a three year time frame continued to remain in the top quartile over the next three years. Over five-year time frames, only one out of five funds could manage this feat”

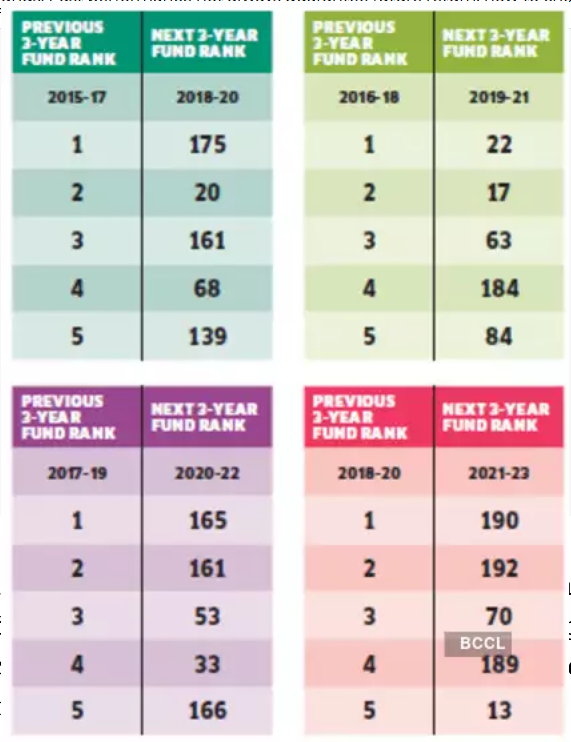

Here’s some more data from the above ET article showing how top ranked funds (based on past 3 year returns) become bottom ranked funds over the next 3 years. For example the top ranked fund based on performance data from 2018 to 2020 became the 190th ranked fund from 2021 to 2023

Arthgyaan has also done an interesting analysis on this for funds in the Indian Mutual History.

For the data below, he assumed that a person invested (and reinvested every year) in the 10 highest performing funds based on the previous 3 years’ performance data.

The middle column in the chart shows returns generated by the top 10 funds of the previous 3 years. The last column on the right shows the returns generated by the top 10 funds of that year itself.

As you can see every year had top funds that were beating the funds that were top performers over the past 3 years period.

Impact of taxes when switching between actively managed mutual funds

When one decides to be in the game of selecting actively managed mutual funds, there is one more significant problem that crops up.

When one has chosen an actively managed fund, one has decided on a strategy that looks to be invested in one of the best performing funds at all times – if not the top performing one, at least one that is say in the top quartile compared to it’s peers. This inevitably means that to stick to your strategy, you will most likely have to switch from one active fund to another. In the bargain, you will be obliged to pay taxes. These taxes will further lower your returns.

This is why, for those of you investing in active funds, it is extremely important to be able to accurately measure the overall returns that your fund switching is finally giving you. This is not easy when switching funds.

My personal experience: Active funds vs benchmark Index

Some years ago, when I used to invest in actively managed mutual funds, I would look at it’s past 3, 5, 7 and 10 year performance in terms of returns generated and select based on that.

I did some due diligence & analysed the 10 year results of the actively managed funds I selected from 2016 onwards. In particular, I looked at how that turned out compared to investing in the corresponding benchmark Index fund over the same 10 year period.

When I did the analysis, 17 out of 25 actively managed funds (i.e. nearly one third of the funds) that I selected based on past performance data gave returns lower than the corresponding benchmark Index. So my personal experience more than validates the data & research above. And this is why I now follow Buffett’s advice to invest in Index funds instead

Summary

In summary, US Data that is available over approx.. 40 years shows that hardly any top performing funds of one decade remain in the top quartile in the following decade. The comparatively limited historical data & reports we have on Indian mutual fund performance data shows a very similar trend as the US Data: Over a 3 year period, only 26% of the funds that were in the top quartile remained in the top quartile over the following 3 year period. That number drops to 20% when we look at 5 year performance data. The trend is clear: The longer the investment horizon you have, the less likely it is that any top performing fund will remain a top performer. Of this you can be almost certain.

My own personal experience of buying dozens of actively managed mutual funds in the past confirms this data. From the set of actively managed funds I invested in from 2016 to 2020 (by which time I had already been investing in mutual funds for 15 year) 17 of 25 funds I selected gave returns lower than their corresponding Index. This was what led me to finally realise (after 20 years !) that for me at least selecting actively managed mutual funds is a fools errand. That’s when I finally switched to investing only in Index funds as advised by Buffet.

To conclude, let me once again quote Bogle: “Choosing a fund based on past performance leads you in the wrong direction. Ignore it.”

Disclaimer: I am not a financial advisor. But I do firmly believe that it is important for everyone to be financially educated. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I am merely someone like millions of other common folk who have been investing in Mutual Funds. I’ve invested in Mutual funds for approx. 24 years. I’ve also been a diligent student of the subject of investing over the past 24 years learning & applying the writings of luminaries in the field such as Dr. William Bernstein, John Bogle, Bill Schultheiss, Michael Edleson, JL Collins, Paul Farrell, Darrow Kirkpatrick, Rob Berger and the likes. In these articles I’m merely sharing my experience & learning from that investing journey and the books of luminaries in the field in the hope that it might help others in some way. Note also that I in no way directly or indirectly claiming to be a hot shot investor who has generated exceptional or even above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes and don’t repeat them, you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments.