Key takeaways

- The 4% rule is critical because it helps calculate what portfolio value you need in order to retire safely

- Looked at another way, it is also critical because it tells you how much you can spend in retirement based on how much you have

- The 4% rule was developed by William Bengen and is based on back testing on US data

- It states that if you withdraw 4% of your INITIAL retirement corpus and later adjust that first year amount upwards for inflation each year, you will most likely not run out of money for 30 years of retirement

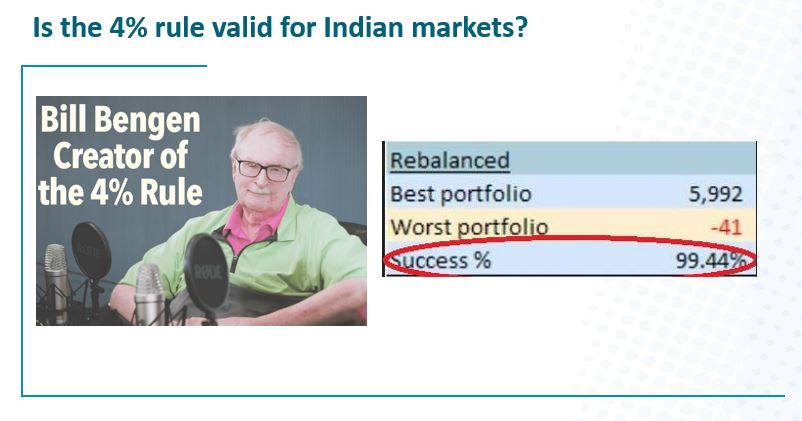

- Sayan Sircar (Arthgyaan.com) did similar research based on 180 rolling data point samples and found that the 4% withdrawal rate had a 99.44% chance of success

- Ravi Saraogi’s research suggests that the minimum withdrawal rate based purely on historical data was 4.7%

- However, based on a number of other factors, both Sayan & Ravi believe that a withdrawal rate of between 3 & 3.5% is better & safer

It is critical to know whether the 4% rule is valid for Indian markets or not because it is the cornerstone of arriving at a safe figure that you need for retirement. On the other hand, if you are either very close to retirement or already retired, it helps you know how much you can safely spend.

In this article, I present some research that has been done on this topic. I would urge you to review the data & make your own conclusion based on these numbers.

What is the 4% rule & what is it’s basis?

The 4% rule states that if you withdraw 4% of your retirement corpus on day one of retirement and then in subsequent years adjust that first year amount upwards for inflation, you will most likely not run out of money for 30 years of retirement.

Important caveats to the 4% rule to be noted are:

- You must have an equity allocation of at least 50%

- Zero advisor fees AND expense ratios were assumed (i.e. ideally you need to be primarily invested in Direct Index funds)

- Annual portfolio re-balancing was assumed

- Intermediate term bonds (between 5 to 10 year maturity) were used

Before we can assess whether the 4% rule is valid for India or not, we need to understand the basis of the 4% rule that Bill Bengen came up with. He came up with the above rule by back testing this based on US stock market & bond data for 50 years.

Below is the chart from his paper that gives us this thumb rule:

As you will see from the chart above, for a 4% withdrawal rate and a 50% allocation to equity / stocks, (rebalanced yearly) the minimum number of years the portfolio lasted is 35 years.

India specific back testing research

Given that Bengen’s method only involved back testing based on real historical data of the US markets, in order to validate whether his rule applies to India, we need to back test against Indian stock & bond market data & see if the 4% rate holds up.

I present below the findings of Sayan Sircar & Ravi Saraogi on the above.

Sayan Sircar’s research on applicability of the 4% rule in Indian context

Sayan Sircar (Arthgyaan.com) did similar research and here were his findings:

The above analysis by Sayan assumes a 60% equity & 40% debt portfolio rebalanced annually. The study above also takes into account taxes. It assumes inflation at 7%. The study Sayan did has 180 data points starting from Apr 1979 until Jan 2024

You can see that the 4% withdrawal rate had a 99.44% chance of success when re-balancing was done annually.

Extract from Ravi Saraogi’s research on the 4% rule in Indian context

Below are the results from Ravi’s research based on historical data:

Ravi felt that the number of data points for a 30 year retirement period were too few given the Indian stock market’s shorter history so for some of the years he used a combination of actual historical data & projected data.

If you want to stick only to ACTUAL historical data, look at the first 12 bars from the left until the period 1991 – 2021

Note that the above data from Ravi is for a 40% equity & 60% debt portfolio re-balanced MONTHLY

Here’s what Ravi stated in his paper on the above data:

“The SWR range starts from a minimum of 4.7 percent and goes up to maximum of 9.4 percent. This wide range displays a declining trend as is evident from the linear trend line fitted on Figure 7. Clearly, SWR in India has been falling consistently. The SWR averaged 8.6% for retirees starting their retirement during the period 1980-1988, fell to 6.3% for retirees starting their retirement in the period 1989-1997 and declined further to 5.5% for those retiring during the period 1998-2006.”

Summary

Sayan Sircar’s back testing of the 4% rule based on Indian stock market data from 1979 to 2024 suggests a 99.44% success rate for a 4% withdrawal.

Ravi Saraogi’s research suggests that the minimum withdrawal rate based on historical data was 4.7%

So technically, the 4% rule does seem valid to me personally. However, both Sayan & Ravi seem to think that based on various factors a withdrawal rate between 3 & 3.5% is truly a safe one rather than 4%.

Some of the greatest minds in investing such as Dr. William Bernstein also suggest a withdrawal rate of about 3%. I would personally have to defer to these great minds on this rather than rely purely on the data.

As you can see, the numbers can be confusing and it’s hard to come to any decisive conclusion on what really is a safe withdrawal rate. So the way I handle it is that I use these numbers (between say 3 & 4%) as a general number within the vicinity of which we do our planning. But then, each year we need to review our portfolio value & see if we have enough left to last us till a ripe old age of say between 90 & 95 years. If not, we make adjustments each year so that we get back on track.

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I’ve invested in Mutual funds for approx. 24 years. I’ve also been a diligent student of the subject of investing over the past 24 years learning & applying the writings of luminaries in the field. In these articles I’m merely sharing my experience & learning from that investing journey and the books of luminaries in the field in the hope that it might help others in some way. I am in no way directly or indirectly claiming to be a hot shot investor who has generated exceptional or even above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes, educate yourself on sound investment principles & develop good financial habits you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments. I shall not be liable.