Key takeaways

- Benchmarking your investment returns at a portfolio level against inflation is important because it enables you to know whether you will be able to continue a similar lifestyle in retirement or not

- The first step is to accurately measure your portfolio returns using a tool that takes into account not just your current investments but also investments you bought and sold in the past

- The best way to get an inflation figure is to track the increase in your own family’s expenses over the years

- If you haven’t been tracking your family’s expenses, you could benchmark against inflation using 2 other methods

- One method is to upload your investments into Valueresearchonline.com and get the data from there

- Another simple way and rough / approximate way is to get public inflation data from the internet and benchmark against that

- If your investments are even just keeping up with your personal inflation rate, you can give yourself a pat on the back

Why measure your investments against inflation

If you don’t want to cut back on your lifestyle in retirement, then an important goal would be to make sure your portfolio has kept up with or has beaten inflation.

See my article here that will help give you a feel for how inflation erodes your purchasing power.

In this article I will cover 3 ways on how to benchmark or check if your investments are beating inflation.

In subsequent articles I will explain other things you might want to benchmark your investment performance against.

Step 1: Accurately measuring the returns your portfolio has generated

Accurately measuring your portfolio returns over time is like an exam report card More importantly, it is what enables you to meet important investment goals like funding your child’s education or retirement. Yet many tools / reports only give you returns on your CURRENT set of investments & miss accounting for those you bought & sold in the past. This is a gaping flaw. You can follow the steps listed in my earlier article on how to use the Kuvera app and get the correct overall historical returns figure for Mutual Fund investments you have bought, sold and kept over the years. With this done, you are through with one very important step for sure.

3 ways to check if you have beaten inflation

Your personal inflation rate: The smartest way to benchmark inflation

The common way to benchmark inflation is to look up data that is publicly available on inflation. However, this is theoretical because the CPI Index has a certain set / fixed weightage to various types of expenses such as food, travel etc. and your family’s spending pattern and weightage might be totally different from the CPI Index. In addition, the kind of restaurants you eat at or the shops from where you buy clothes might have very different (mostly higher) prices compared to what was used as a reference to calculate the CPI Index.

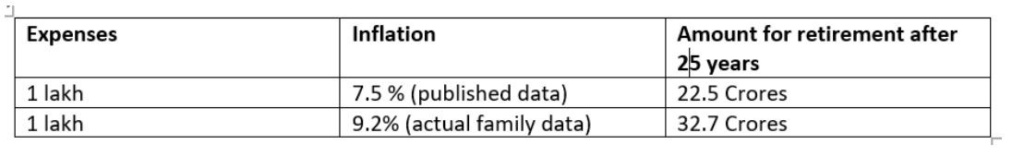

So the most practical & useful way to glean inflation data is to look at the trend of your own family’s personal expenses over the past 5, 7 or 10 years. You could read another article of mine which demonstrates that even a 2% error in inflation assumption could result in a financial planning target of approximately 10 crores over a 25 year period.

In my own case for example, our family’s personal expenses seem to have been increasing at a rate of between 7.8% to 8.3% per year.

So let’s say your investments were making 8%. If you chose to believe public data that suggested inflation was 5%, you might feel very good or happy that your investments were beating inflation by 3%. However, if, like me, your personal expenses were in reality increasing at about 8%, you would be deluding yourself. In this case, the reality would be that your investments are just about keeping up with inflation

To calculate your personal inflation rate you could use this calculator from freefincal here

Overall, if your portfolio of investments have even just matched your own personal inflation rate, you may give yourself a pat on the back. Job well done !

Benchmarking against inflation using Valueresearchonline.com

If we want accurate benchmarking against the public inflation rate for the specific period we have been investing, we can use the Valueresearchonline “My Investments” / “Portfolio tracker” tool. Here’s an article from Valueresearchonline that helps guide you on what you need to do to get all your investments imported into the tool. It’s super simple, easy & convenient. If you have any trouble doing this, drop me a direct message and I can help.

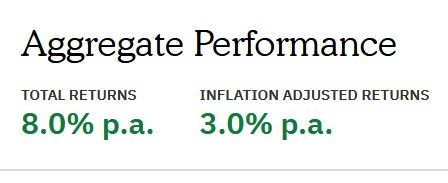

See the screenshot below of a dummy sample portfolio. The figure on the right is the one to focus on. In this case, the person’s investments have beaten publicly declared inflation by 3%.

As per value research the person’s entire portfolio of investments including equity, debt, bonds etc. has generated 8% returns on aggregate. This returns figure is an “All-Time return” that I believe includes investments bought & sold / completely exited in the past. So this is also a reasonably accurate returns figure.

Valueresearch seems to have calculated that that for the period during which this person has invested, the average inflation has been 5% and so they have generated returns 3% higher than inflation.

Benchmarking against inflation using public inflation data

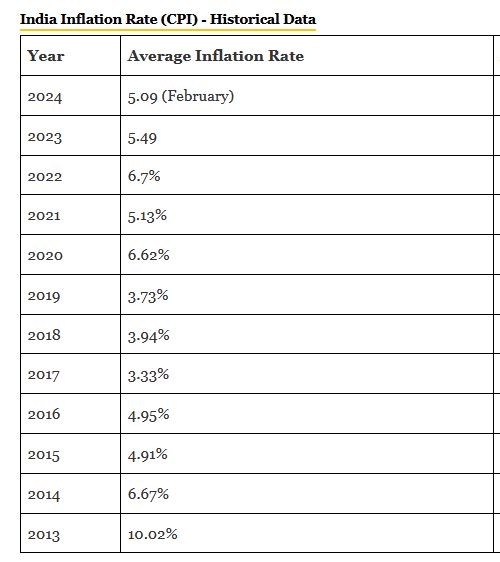

Alternately, here’s a quick approach if you just want a general, high level, approximate feel for whether your investments have beaten public inflation.

Google for average CPI inflation data for the years during which you’ve been investing. and check your investment performance from step 1 above against that.

Below is an example of inflation data from Forbes So, if for example you have been investing since 2015, then the average inflation rate from this data would be approx.. 4.97%

The second & third method above, while less than ideal, do give you some sense of whether your investments are keeping up with the general rise of prices. At the very least, what they tell you is whether you would be able to keep up with inflation if you lived a modest & frugal life in retirement.

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I am merely someone like millions of other common folk who have been investing in Mutual Funds. I’ve invested in Mutual funds for approx. 22 years. I’ve also been a diligent student of the subject of investing over the past 22 years. In these articles I’m merely sharing my experience & learning from that journey in the hope that it might help others in some way. Neither am I in any way directly or indirectly claiming to be a hot shot investor who has generated exceptional or above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes and don’t repeat them, you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments.