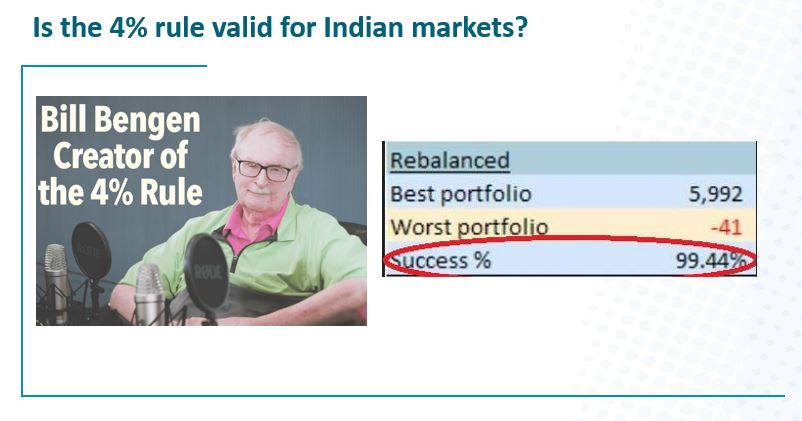

Key takeaways For a 4% SWR & 50% equity allocation no one had less than about 35 years before his retirement money was used up. For a 3% to 3.5% withdrawal rate even a 50:50 equity debt portfolio always lasted…

Key takeaways For a 4% SWR & 50% equity allocation no one had less than about 35 years before his retirement money was used up. For a 3% to 3.5% withdrawal rate even a 50:50 equity debt portfolio always lasted…

Key takeaways The 4% rule is critical because it helps calculate what portfolio value you need in order to retire safely Looked at another way, it is also critical because it tells you how much you can spend in retirement…

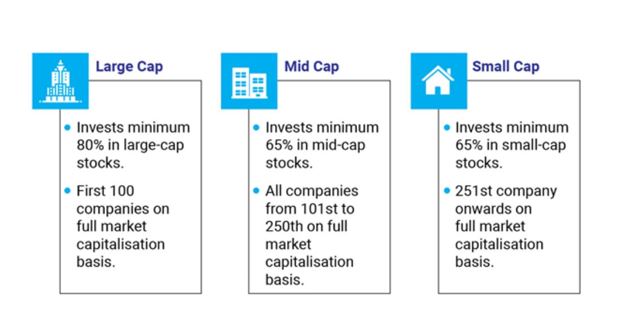

Key takeaways In the short term certain fund categories can generate astronomical returns But most such funds also carry a high risk & probability of falling as hard as they rise If any fund you own is generating high returns,…

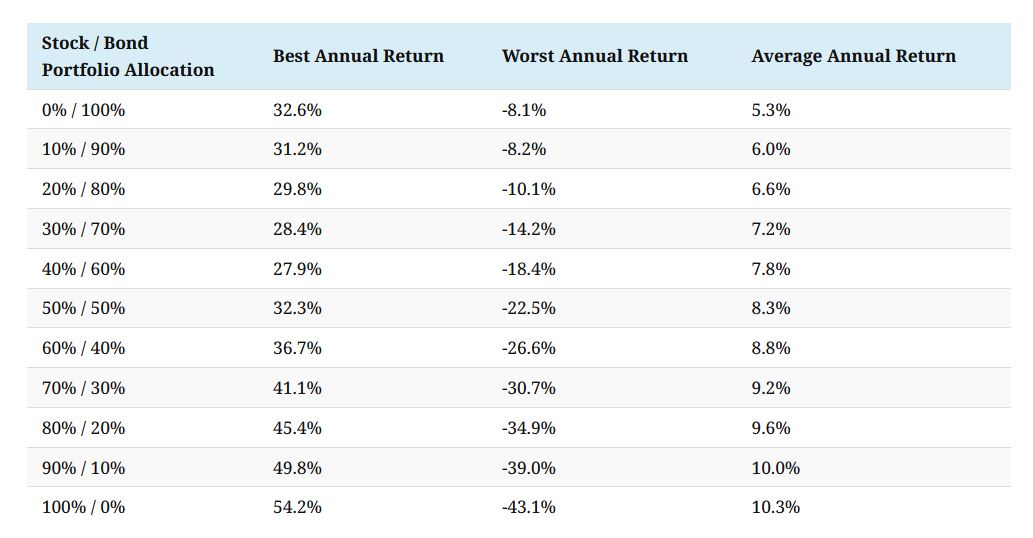

Key takeaways: Increasing the percentage of equity / stocks in your portfolio is a near sure fire way to increase the long term returns from your portfolio But increasing equity / stocks also makes your portfolio much more volatile in…

Key takeaways More risk = More return & Less risk = Less return If a scheme promises high returns with low risk it’s most probably a scam When we see high returns we normally never seek to question them On…

Key takeaways It’s easy to get carried away when we see attractive returns from an investment This is when we need to look at the other side of the coin & make sure we do due diligence on the risks…

Key takeaways Due to various circumstances, many of us may not be able to reach the ideal retirement target number To deal with this we work backwards from our net worth to know how much we can spend Ravi Saraogi’s…

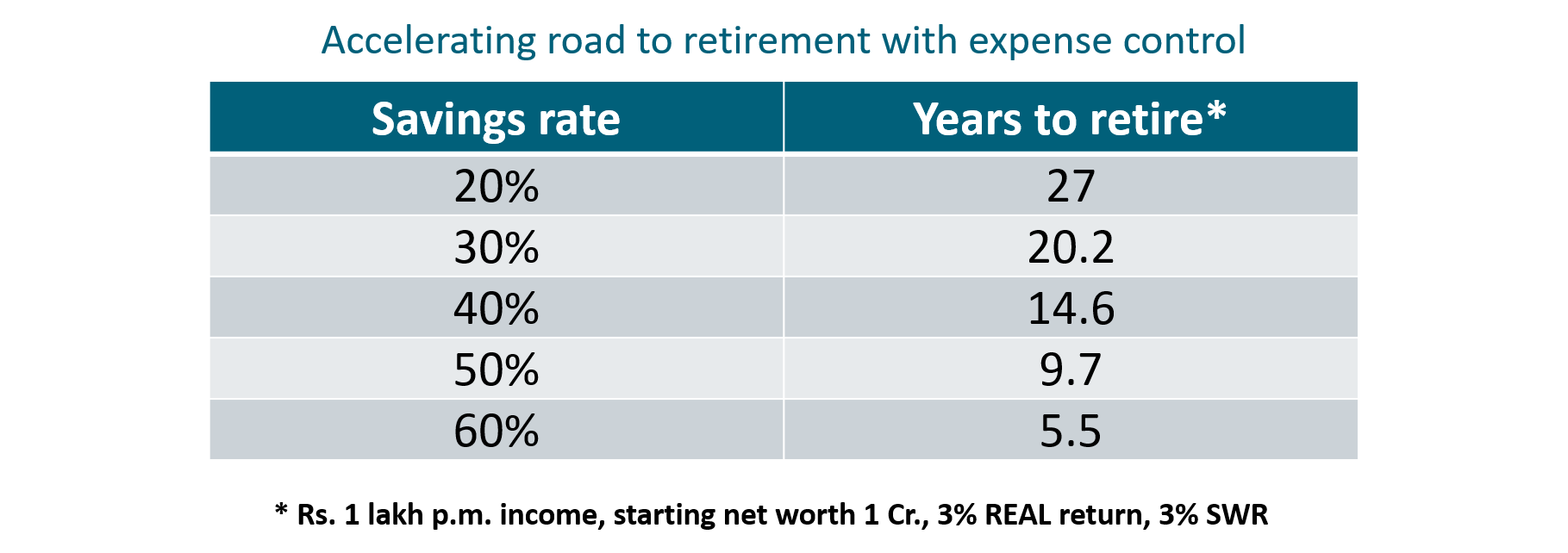

Key takeaways Planning for retirement can be discouraging given how far away the goal typically is & how slow the initial progress can seem Creating intermediate milestones to retirement can encourage you stay on track for the retirement goal Having…

Key takeaways Hera are the list of potential risks or difficulties when one buys a property: Difficulty in determining fair price of purchase / sale Difficulty in ensuring clear title to property Large amount needed to even just get…

Key takeaways Numbers thrown up by retirement calculators can look scary & unachievable at times In response, many try to get aggressive by investing in schemes that promise high returns. But this is most often a mistake since it…