Key takeaways

- Making the decision to invest a lump sum takes more than data

- A crash could occur the very next day after your SIP completes thereby putting in question the whole SIP approach

- So the key question to really answer is whether you have truly chosen an asset allocation that works for you

- Another key question to ask is whether your risk tolerance has changed recently, thereby causing you to revisit your asset allocation

So here is one way to think about it before making a decision either way.

Scenario: A Crash one day after SIP completion

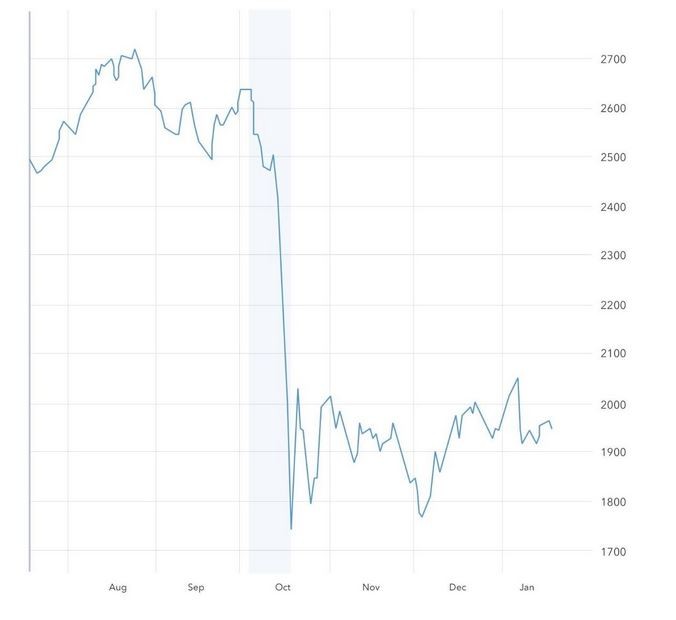

Well we all know that markets are totally unpredictable: They could rocket upwards on any day / week and they could crash any day or week.

So the hard question to ask yourself is this: What if you’ve been investing via an SIP diligently for 36 months and the market crashes in the 37th month after you started your SIP?

Well in month 37 you finally have your 1 crore fully invested in equity and the loss you would incur in month 37 is the same that you would incur had you put in the money as a lump sum on day one

So in effect, all that an SIP does is that it delays the time period / date at which you take the risk.

Let’s say you have some kind of an unpredictable (but low probability) life situation that will require you to draw on the money you had originally earmarked for investing in equity. In such a case only perhaps does an SIP make sense.

The above scenario takes us back to the age old but most important question of what Asset allocation works personally for you. If you’ve thought through your asset allocation wisely and well, you’ve come to an allocation where the bond or debt portion of your portfolio is more than sufficient for you to ride out the rough times in stocks.

For example, for a person that has set aside say 10 years of expenses in Bonds, a stock market crash, decline or bear market that lasts even say 3 or 5 years will not cause them any worry or trouble. So with an asset allocation like this, they could quite likely comfortably invest a lump sum into the market.

Another way to look at your asset allocation from an emotional perspective is to ask yourself whether you can handle a 50% drop in the value of your equity investments overnight.

So if you’ve got enough debt investments to last you through a long bear market in stocks and you’ve got the stomach to handle a 50% decline in the value of your equity investments, you should ideally be able to invest a lump sum (irrespective of the absolute value) as long as you are within the asset allocation you know you can handle.

Has anything recently caused an increase or decrease in your ability to take risk?

The other interesting question to ask is whether this lump sum or any other recent event in your life has significantly changed your ability to take more or less risk. For example, when Jack Bogle was diagnosed with an illness in the early 2000s he actively set about reducing his stock allocation. On the other hand, it’s possible that a lump sum windfall might actually increase your ability to take risk.

The correct question to be asking yourself

So the correct question to ask in effect is not whether you should invest a lump sum in one shot or as an SIP. The question to ask is: “Is my asset allocation correct & truly safe enough for me and my current situation?” If it is, then you should be able to invest a lump sum, if not, you need to revisit your asset allocation and possibly increase the amount allocated to bonds.

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I am merely someone like millions of other common folk who have been investing in Mutual Funds. I’ve invested in Mutual funds for approx. 22 years. I’ve also been a diligent student of the subject of investing over the past 22 years. In these articles I’m merely sharing my experience & learning from that journey in the hope that it might help others in some way. Neither am I in any way directly or indirectly claiming to be a hot shot investor who has generated exceptional or above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes and don’t repeat them, you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments.