Key takeaways

- In the short term certain fund categories can generate astronomical returns

- But most such funds also carry a high risk & probability of falling as hard as they rise

- If any fund you own is generating high returns, first ascertain it’s category / classification

- Then familiarize yourself with historical data on that category’s worst phases

- There are 3 angles of a fund’s past to analyse with regard to it’s worst phases: returns variation, extent of fall in a crash & time to recover

- Small cap funds have given annual returns ranging from plus 87% to minus 26% yet only returned about 15% over 15 years

- While large caps fell 55% in the 2008 crash, small caps fell by 73%.

- Mid cap & small cap funds in general can fall between 60 to 80% in a crash and stay down for anywhere between 1 to 5 years

- Similarly, with small cap funds one has to be prepared to hold for over 3 years despite zero returns

- Similarly in the dot com crash around year 2000, IT sector funds took 13 years to recover to their original level

- In summary, look at all the crash & recovery data before you get carried away & invest in any fund category that is generating super high returns in the short term

Super high returns? But for how long & at what risk?

It’s possible that some funds in your portfolio are generating super high returns (above say 20% over the short term). But are you aware of the level of risk with those couple of funds generating super high returns in the short term?

In an earlier article of mine, I wrote about some of the most high level risks one needs to consider when investing in equity. In a subsequent article, I wrote about the next aspect of risk to assess which is your equity vs debt asset allocation. In this article I look at drilling down further into your equity investments to assess risks at an individual investment level.

Steps to assess risk level of individual investments

Whenever you see any fund generating super high returns you need to

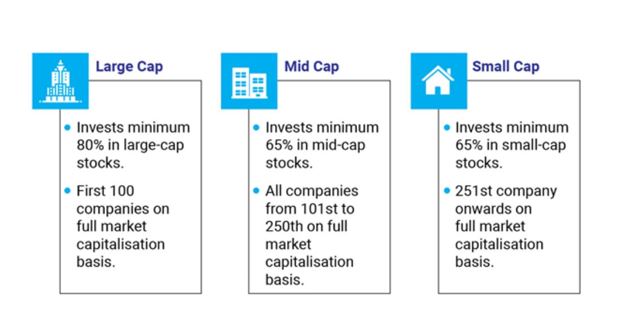

- Understand what category of fund that is: Is it a large cap, mid cap or small cap fund? OR Is it a sector fund? (this can easily be done by Googling the fund and going to the fund’s data page on Valueresearch)

- Familiarize yourself with how risky or not that category of funds is. The data & charts below will help you get a feel for how risky (or not) each category is.

Three angles of risk to consider when evaluating each fund category

- The first kind of risk one needs to be able to bear with mid cap & small cap funds is the wild variation in returns on a year to year basis even when things are “normal” by equity market standards.

- The second kind of risk one has to be prepared for is with regard to HOW MUCH they can fall when there is a CRASH. i.e. do you have the financial & emotional strength to bear such gut wrenching or stomach-churning falls in valuation

- The third type of risk one needs to be prepared for is in terms of HOW LONG these kinds of stocks & funds take to recover from crashes. i.e. do you have the financial & emotional strength to hold on for long enough to see them recover.

Historical data for perspective

Dr. William Bernstein has repeatedly said that in order to be a good investor you should have a good grasp of market history. So below we shall look at some charts & data that will give us a perspective on risk and returns of the mid & small cap as well as sector fund categories over long periods of time.

It’s easy to get carried away when we see mid or small cap returns in the 30s, 40s or higher. But it is at times like these that we must bring ourselves down to earth by looking at long term data charts like the ones below. Remember that super high returns do happen frequently but they are mostly short lived and just like gravity, the principle called “reversion to the mean” takes effect sooner or later & brings long term average returns constantly down to more reasonable levels.

In the data below, I highlight charts for a sampling of 3 categories of funds that typically carry higher risk: Mid caps, small caps & sector funds

Wild variations in returns with small caps

Let’s start by having a look at the chart below that shows 15 year data on small cap funds. Notice that on the positive side they have even generated an incredible 87% returns. However. On the flip side they have also given minus 26% in some years.

Notice also, that all put together however the swings have returned 15% over a 15 year period which is not that much higher than the Sensex returns. So you have to bear much higher volatility for a small gain over the Sensex.

Small caps vs Large caps in 2008 crash

Now let’s look at another perspective. How much small caps could fall in a crash. Look at the data below: While the BSE 100 i.e. Large caps fell 55% in the 2008 crash, but small caps fell by 73%. Yet another example of the kind of stomach-churning volatility one has to be prepared for when one invests in small caps for example.

Mid & small cap fund recovery times

Have a look at the charts below from Valueresearch for how long it takes mid cap & small cap funds to recover from crashes..

You can see from the data above that mid cap & small cap funds in general can fall between 60 to 80% in a crash and stay down for anywhere between 1 to 5 years. In summary, this is what you need to be prepared for if you invest in mid cap or small cap funds.

In the chart below is yet another angle from which you could look at the risk of small cap funds: How long you have to be prepared to hold without seeing any positive returns at all

You can see from the 2nd column above that one has to be prepared to hold for as long as 3 years & 4 months to just break even sometimes.

Sample of risk in sector funds

Mid cap & small cap funds are two categories of funds that could be considered risky and that one should look out for from a risk perspective in one’s portfolio. Another category of funds that that one should look out for from a risk perspective in one’s portfolio are sector funds. These are funds that invest in companies from just one Industry. For example, only healthcare companies, automotive companies, IT companies etc. These are risky because there are phases where an entire sector (irrespective of the company) such as automotive or IT is not doing well due to macro level economic factors. In such circumstances stocks of ALL companies in that sector would do badly and so sector funds investing that sector would do badly.

A broadly diversified large cap fund on the contrary, invests in companies across Industry sectors and is therefore safe from what could be called sector risk.

Look at the chart below for a worst case scenario on how the IT sector performed post the year 2000 dot com bubble.

You can see that it took 13 years for the IT sector to regain the level it touched in the year 2000. Now that’s sector concentration risk right there for you.

In summary, look at all the crash & recovery data before you get carried away & invest in any fund category that is generating super high returns in the short term

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I’ve invested in Mutual funds for approx. 24 years. I’ve also been a diligent student of the subject of investing over the past 24 years learning & applying the writings of luminaries in the field. In these articles I’m merely sharing my experience & learning from that investing journey and the books of luminaries in the field in the hope that it might help others in some way. I am in no way directly or indirectly claiming to be a hot shot investor who has generated exceptional or even above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes, educate yourself on sound investment principles & develop good financial habits you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments. I shall not be liable