In my earlier article, I demonstrated a simple way to do a dipstick calculation to validate whether one has sufficient funds to retire TODAY.

For most folks however, the answer is likely to be that we don’t have sufficient just yet. So this short article looks at a simple way to calculate how much one would need to be able to retire.

Step 0: Pre-requisites before you get into investing

Before you get into investing into Equity though, you need to make sure you have other basics of personal finance in place. It’s what I’d like to call Step 0 of investing and it involves putting in place the following:

- An emergency fund of at least 6 to 12 months of expenses

- A Term Life Insurance Policy

- Children’s education expenses planned for (unless it is more than 10 years away)

- Medical Health Insurance

- Any major expected expenses over the next 4 to 5 years set aside

- Mindset and / or temperament to invest in equity. I shall cover this in a future article.

Steps to calculate retirement amount needed

Once all the above are in place, at a high level here are the simple few steps you need to take to be able to calculate what your net worth needs to be to retire comfortably

- Track your expenses. Most importantly track how much your most ESSENTIAL expenses are.

- Track your “personal rate of inflation” i.e. track the rate of increase in YOUR family’s yearly ESSENTIAL expenses i.e. exclude non-essential / discretionary expenses

- Based on inputs from points 1) & 2) above, calculate what your expenses will be in the first year of retirement. Message me if you would like a simple excel sheet that can help you do this.

- Multiply the value in point 3) above by 33. This is the amount you need to have on the date of retirement

Note that step 4 above is based on what is a world famous “4 percent rule”. If you would like to get into more details on how this was arrived at, you could read my article on the 4 percent rule here.

If you are very busy & pressed for time, the above steps (and trust in the modified four percent rule) are all you need in order to calculate the value of your investments at retirement.

If you’d like to understand these steps better, below are some sample illustrations and details.

Sample retirement investment calculation

I’ll use my simple excel sheet to demonstrate how the calculations can be done.

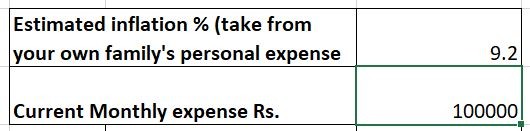

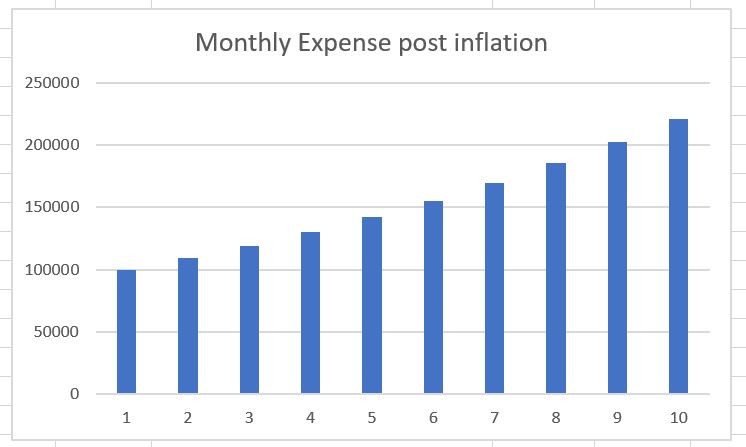

I’ve assumed a round figure monthly expense of Rs 1 lakh. I’ve also assumed that by diligently doing steps 1) and 2) above you have concluded that your family’s ESSENTIAL expenses are rising on average at 9.2%

Now let’s assume you are 48 years of age and consequently about 10 years away from retirement.

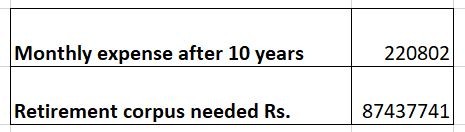

The Excel sheet calculates that at this assumed rate of inflation, Rs 1 lakh of expenses will rise to approx. 2.2 lakhs in 10 years.

Based on a version of “the 4 percent rule” adapted for India, (we are actually using the 3% rule to stay safe) it conservatively calculates that you should have 8.75 Crores within 10 years to be able to retire

If you’d like some help to do your own calculations like the above one, send me a message and I will send you a simple excel sheet to help you do the calculations and arrive at your own retirement figure.

Disclaimer: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. I am merely someone like millions of other common folk who have been investing in Mutual Funds. I’ve invested in Mutual funds for approx. 22 years. I’ve also been a diligent student of the subject of investing over the past 22 years. In these articles I’m merely sharing my experience & learning from that journey in the hope that it might help others in some way. Neither am I in any way directly or indirectly claiming to be a hot shot investor who has generated exceptional or above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes and don’t repeat them, you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments.