Key takeaway

- An Investment Plan acts as a blueprint for financial success.

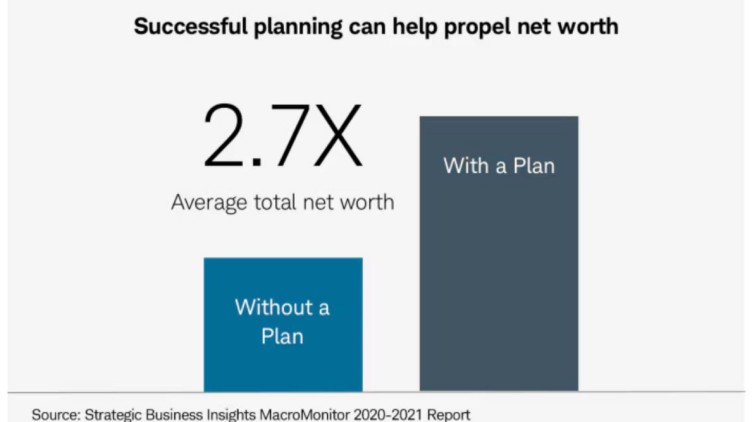

- An investment plan can boost net worth by 2.7 times

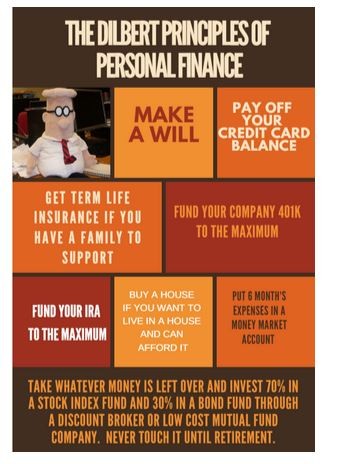

- For the simplest investment plan see Dilbert founder Scott Adams’ take on this

- Step 1: Calculate required amount for the goal as of today

- Step 2: Factor in inflation to estimate how the much amount in step 1 will become after some years

- Step 3: Secure term life and health insurance before investing.

- Step 4: Build an emergency fund covering 6–9 months of living expenses and short-term needs in low-risk debt instruments

- Step 5: Assess your risk tolerance & decide on equity vs. debt asset allocation

- Step 6: Choose mutual fund types using simple Lazy Portfolios adapted to the Indian market

- Step 7: Decide between lump sum investment or staggered investments based on available funds

- Step 8: Calculate monthly SIP required to reach retirement goals

- Step 9: Choose between active and passive funds; consider Warren Buffett’s endorsement of passive index funds.

- Step 10: If choosing active funds, prioritize low expense ratios and consistent long-term performance as per Bogle’s criteria

- Step 11: Select appropriate index funds for chosen equity categories

- Step 12: Pick suitable debt fund categories aligned with your risk tolerance.

- Step 13: Conduct annual reviews to: Track progress toward retirement goals. Benchmark returns against relevant indices. Re-balance asset allocation as needed. Gradually reduce equity exposure 5–7 years before retirement.

Why create a thorough end to end investment plan?

Creating an investment plan is the equivalent of creating a blueprint when constructing a house. It would seem rather unwise to start building a house without an architectural blueprint. Likewise, it would be rather unwise to start investing without having a clear investment plan. However, many people tend to start investing without a well thought out end to end investment plan. Research suggests that having a clear end to end investment plan can increase your net worth by 2.7 times

Perhaps the best example of the shortest and yet one of the wisest investment plans ever was put together by the creator of the Dilbert comic strip, Scott Adams.

I can assure you that 80% of all the wisest financial investment advice you’ll ever need is in the infographics pasted above.

While I would readily admit that I’m nowhere close to as brilliant as Scott Adams, below is my take on the simplest version of the steps that I can offer to get an investment blueprint ready for a goal like retirement

The same principles however could be applied to any financial goal. Examples of other such goals could be to accumulate sufficient money to buy a house, fund your child’s education or buy a car. Whatever the goal, the steps are in many ways very similar.

Below, I’m using the example of creating an investment plan for the goal of retirement. Should you wish to dive deeper into any of the steps, for most of the steps listed, I’ve also linked to other articles of mine as well as many other links to good content on the web.

Step 1: Calculate the amount needed for retirement today

This article helps you get a feel for how far away from your retirement goal you are right now. i.e. what the gap is as of today. It’s based on the famous “4% rule”. It explains some of the important nuances of the 4% rule that originated out of studies in the US and also points to certain studies done on this for it’s relevance & applicability to India.

Step 2: Calculate amount needed for retirement WHEN you retire

The amount you need to have In order to be able to retire a few years or decades down the line would be much higher than the amount calculated in Step 1. This is because of inflation. This article illustrates how to arrive at how much you will need to retire in the year a few years or decades down the line.

Step 3: Buy basic Insurance

Make sure you have term life insurance & medical insurance in place before you start investing

Step 4: Set aside funds for Emergency & short-term needs

Equity investing is safe only when done for long periods of time. By long, I mean 7 to 10 years. So before investing, it’s important to set aside or save and invest separately for all short term (less than 7 years away) goals and needs or mandatory non-negotiable expenses expected to be incurred within the next 7 years.

Examples of such needs / expenses could be vacations, a new car etc.

One should also set aside sufficient funds for any emergencies e.g. medical expenses as well as 6 to 9 months living expenses

These should all be in non-volatile Bank Fixed Deposit like investments called “Debt” investments

Step 5: For long term goals, decide on your overall stock vs bond Asset allocation

This is a BIG decision that can have a massive impact on your investment returns long term. So take your time & read or research this topic thoroughly before you make a choice.

Decide how much money to put into equity (stock market) vs debt (FD like investments). Just as an example, let us assume that you have Rs. 10 lakhs available to invest and you chose to put 60% into equity and 40% into debt.

One last point before you finalise your stock or equity allocation. Ask yourself this key question as an acid test: Can you afford to see your equity investments fall by 50% and not recover for 10 years?

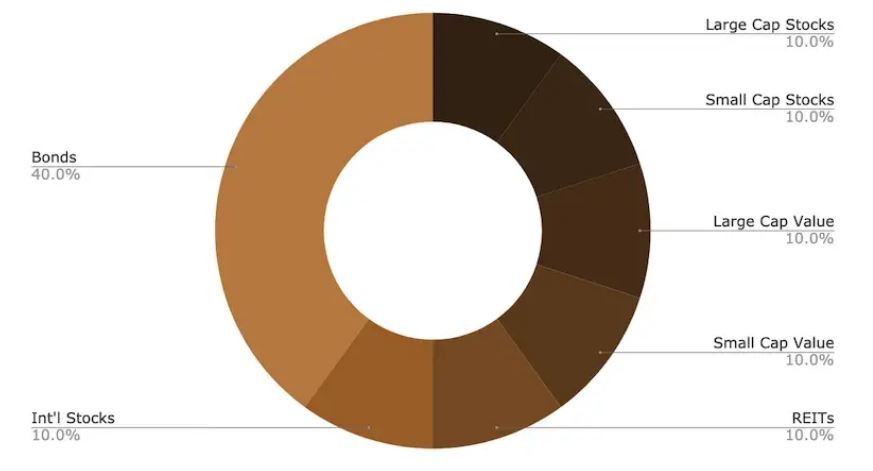

Step 6: Decide what types of funds you want in your portfolio and how much of each

Here your end goal is to make a list of the types / categories of mutual funds you want & percentages for your portfolio composition.

There is a very wide range of categories of equity funds as well as an equally wide range of categories of debt funds. Theoretically there are an infinite and perplexing number of combinations of equity and debt fund categories that one could choose to have in one’s portfolio in varying percentages.

In reality, this is where you need to make your own personal choice of what combination of asset class categories works best for you. However, I would readily admit that it can be very perplexing or confusing. So the approach I take is to pick from a set of tried and tested portfolio combinations that luminaries in the world of Finance have come up with. The term for these tried and tested ones is “Lazy Portfolios”.

I’m personally a great fan of simplicity so the portfolios I like best are the 3 fund portfolio, the “Couch potato portfolio, Bernstein’s No Brainer portfolio, the Coffeehouse portfolio and the Warren Buffett portfolio

Note 1: All of these came out of the USA so we could replace the US Stock portion with Indian stocks etc. The key is to glean the basic principle of allocation across major asset classes and in what proportion to have them

Note 2: You also need to consider carefully whether a specific asset class in the lazy portfolio is mature enough in the Indian market e.g. REITs

Step 7: Decide whether to invest a Lump sum into Equity or not

If by chance you have available a large chunk of money readily available (say from the sale of a property etc.) to also put into equity, use this article by Bill Jones to decide whether to put it into equity as a lump sum or to stagger the investment and over what period to stagger it out.

Another way to look at deciding on whether to invest a lump sum into equity or not is by taking a good hard look at your asset allocation.

For further reference, here’s some data backed analysis of lump sum vs SIP investing based on US studies done on by well known fund houses like Vanguard & DFA

Step 8: Choose a methodology and calculate monthly investment needed for equity investing

Since most people can’t handle the risk / volatility of lump sum investing, it is normally not advisable to put a lumpsum into equity. Instead they need to decide on a methodology by which to build up the equity portion of their investments to the target asset allocation

1. If you choose an SIP, calculate what is the monthly SIP amount you need to invest in order to be able to reach your target amount by the year in which it will be needed

2. If you choose the Value Averaging methodology then you will need to create what is called a Value Path

Step 9: The active vs Passive Mutual fund choice

The next step you need to take is to educate yourself about both the differences as well as pros and cons of active vs passive investing.

This is a BIG decision that can have a massive impact on your investment returns long term. So take your time, read widely and understand both choices thoroughly before you make a choice. Here’s a sample article from Goldman Sachs that goes into the pros and cons of active Vs passive investing. and another one from Wharton’s Executive Education program.

Warren Buffett also recommends Index funds as the best option for most retail investors. Buffett also won a million dollar bet with hedge fund managers that they wouldn’t be able to beat the S&P 500 Index over a 10 year period. Last but not least, Buffett has directed the trustees of his Will to invest 90% of his estate (read, tens of billions of dollars of his own money) in just one S&P 500 Index fund.

Step 10: If you want to invest in actively managed funds

You could decide to choose an actively managed fund in any way you see fit. My personal favourite though are John Bogle’s criteria. Among other things he recommends:

1. Looking at the total expense ratio (TER) of the fund

3. Reviewing consistency of a fund’s performance over a decade or more

Step 11: If you chose passive investing, choose Index funds for each equity category in step 6

Choose an Index fund as per the criteria given in this article from Arthgyaan or this article from Freefincal

Step 12: Decide on the correct debt fund categories & specific funds

Use the guidelines given in this article from freefincal to decide on which types / categories of debt funds to invest in.

If you would like to do a deep dive to understand the various types of debt funds and their risks in detail, you could read this article from Arthgyaan

Step 13: Do an annual review of your investment plan

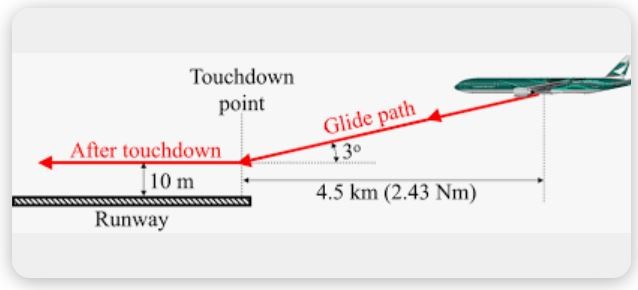

Reviewing your investments once a year is the equivalent of a pilot constantly checking if he’s on the right “glide path” to land an aircraft at the exact correct point for a smooth touch down and landing.

If you do such a review annually, you will find that you will reach your financial goals smoothly. Here are the key steps you need to perform for an annual review.

a) Check whether you are on track for your goal: This step is where the most important thing you want to look at is whether the accumulated value of your investments is above or below the value it’s planned to be at (as of the year & month of the review) as per the monthly SIP sheet explained in Step 8. If it’s on track or above well & good. If it’s below, revisit the assumed values you used and the SIP amount and adjust so you can get back on track to achieving the target amount by the target date.

b) Review overall returns at portfolio level: Accurately measure the overall performance and ALL TIME RETRUNS of your portfolio In particular, check if the overall returns of the EQUITY portion of your portfolio are equal to or higher than the returns of the Nifty 50 or SENSEX. If it’s not beating the index, you might want to consider switching to an Index fund

c) Review performance of individual investments: Benchmark the returns of each individual investment in your portfolio against it’s CORRESPONDING INDEX. E.g. a Midcap fund should be benchmarked against a Midcap Index not against the Sensex or Nifty 50 If it’s not beating the index, you might want to consider switching to an Index fund

d) Rebalancing: This step requires you to look at your planned allocations in step 6 above and bringing the percentages back to what was planned. In general, it’s better only to add more funds to rebalance rather than sell because selling triggers taxes

e) De-risk as you approach goal: In the last 5 to 7 years as you approach your goal, it’s a good idea to systematically de-risk your portfolio. In simple terms, this means you gradually reduce your equity allocation percentage (decided in step 5) as you approach your goal.

Conclusion: Creating a comprehensive investment plan for retirement is crucial for achieving long-term financial goals. By following these well-defined steps—ranging from calculating retirement needs and setting up emergency funds to making informed choices about asset allocation and fund selection—you can build a robust portfolio tailored to your risk profile and retirement timeline. Regular reviews and timely adjustments ensure that your investment plan stays on track, adapting to market conditions and life changes. With disciplined execution and thoughtful planning, you can secure a financially stable and fulfilling retirement.