Key takeaways

- Investment performance measurement has a range of dimensions and angles

- One way to start measuring investment performance is to measure the overall historical returns at a portfolio level

- A next step could be to check whether you’ve managed to beat inflation at a portfolio level

- If the results at a portfolio level are not satisfactory, you might want to drill down into each mutual fund to eliminate the ones that are not performing

- One relative way to evaluate performance of a mutual fund is to use Bogle’s performance consistency criteria

- This article looks at an absolute (rather than relative) and most basic way to benchmark a fund’s returns: Whether it has beaten it’s benchmark or not

- An investor is regularly paying fees between 1.5% to 2% to mutual funds. These fees are worth it ONLY if at the very least the fund is able to beat it’s benchmark CONSISTENTLY OVER MANY YEARS (say 10 years)

- 1.5% to 2% in fees might look like a small number but as Rob Berger has shown, over a 45 year period, a 2% fee can reduce a retirement investment from $3.1 Million to $1.7 Million

- Benchmarking your fund’s returns against it’s corresponding Index can be done easily using data on Valueresearchonline.com

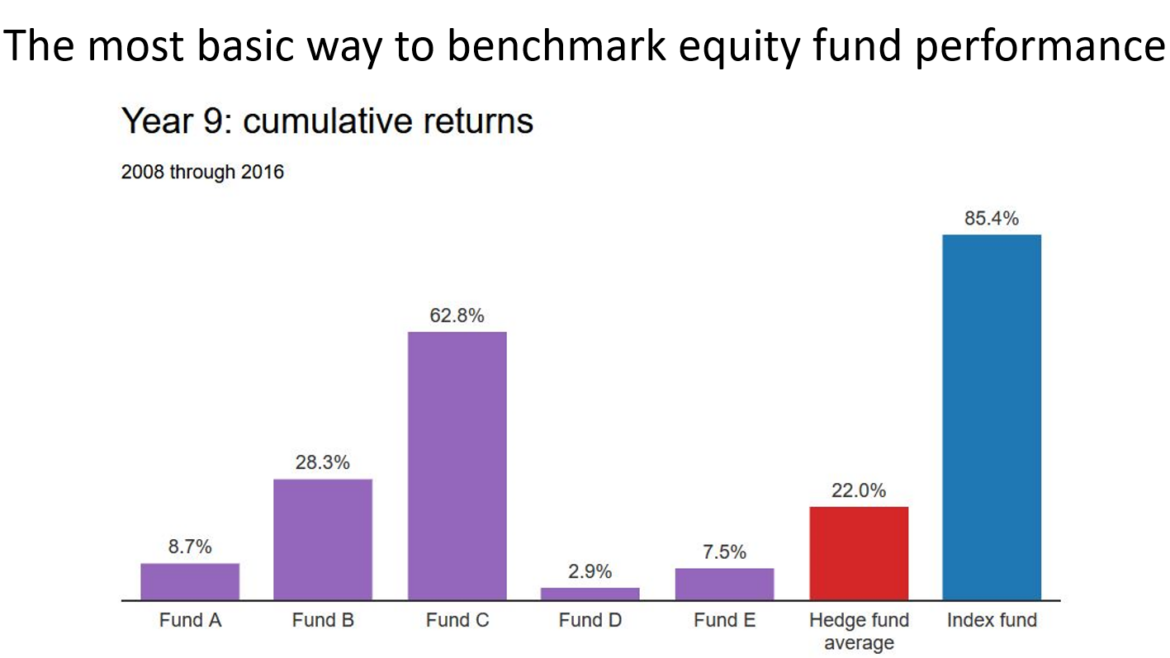

- Most actively managed funds fail to beat their benchmarks over a 10 year period. This is why Warren Buffet took & won a million dollar bet that no fund manager would be able to beat the S&P 500 Index over a 10 year period.

- Watch out for funds that suddenly change their names & benchmarks. This could potentially make the data seem very rosy but it is a trick

- Watch out for one more pitfall. Many times small cap funds seem to be beating the small cap Index however they fail to beat the mid cap Index

A top down approach to reviewing investment returns

In an earlier article of mine, I explained how to measure the overall returns of your portfolio including investments that have been bought & sold in the past.

In another article of mine, I explained that once you know how to accurately measure your returns at a portfolio level as explained above, one way of knowing whether you were doing well or not at a portfolio level was to check if at a portfolio level you had managed to beat inflation. More importantly, if it has beaten your PERSONAL INFLATION RATE.

If you do the above measurements diligently & find that the overall returns of your portfolio are not satisfactory, then you need to dig deeper to identify the ones that are dragging your returns down.

In yet another earlier article, we looked at John Bogle’s quartile consistency criteria as a way to measure how well or not a fund is performing. Looking at quartile consistency tells you how your fund is performing relative to it’s peers. So the above is a RELATIVE measure of performance. This article on the other hand talks about a more absolute measure of performance.

However, one of the most important and basic criteria for an Equity mutual fund is that it must be able to beat it’s CORRESPONDING BENCHRMARK INDEX.

In this article I will show you the simple way to do this.

Why compare your fund performance to it’s corresponding benchmark index?

A mutual fund manager is expected to use his / her skills & judgement to pick stocks and provide you with better returns than a known set of companies in the corresponding benchmark Index. It is mainly for this potential SKILL of a fund manager that the Total Expense Ratio of between 1.5 to 2% is charged to you as an investor.

If your fund is not providing better returns than it’s corresponding Index, then you are effectively giving up 1.5 to 2% of your investment returns for nothing. You could easily just pick an broad based market cap weighted Index funddirectly yourself without any professional stock picking skills on your part.

Impact of fund fees: $3.1 million down to $1.7 million over 45 years

Here’s an example from Rob Berger, I quote from his article, “How investment fees affect wealth” below:

How Fees Affect Your Wealth

Let’s imagine that we make the maximum contribution to an IRA ($6,000) during our working years from age 20 to 65. If we earn an average of a 9% return on our investments, we’ll retire with about $3.1 million (gotta love compounding).

Now let’s assume we pay an investment advisor a “small” 1% fee. Our retirement fund drops to $2.3 million. Add in a 1% expense ratio on the mutual funds, and our nest egg falls further to $1.7 million. Yeah, fees matter.

This is why it’s important to check if your fund is beating it’s Index. Because over decades the seemingly small fees of an actively managed fund of 1.5 to 2% can amount to literally millions !

Steps to compare your fund’s returns to it’s Index

For the reasons mentioned in the previous para above, the most basic performance criteria for an actively managed mutual fund to earn the right to be selected into or remain in your portfolio is that it needs to be able to beat it’s CORRESPONDING BENCHMARK INDEX. And the more consistently it has beaten it’s index over the past decade or more, the better the fund.

- Search for Your Fund: Use Google to search for your mutual fund’s name along with “valueresearchonline.”

- Navigate to the Returns Tab: On the fund’s page, click the “Returns” tab.

- Check Rolling Returns: Select the “Rolling Returns” tab. (A subscription may be required. Without one, you can use trailing returns, though they may not provide as accurate a picture.)

- Choose a 10-Year Period: Click on “10y” on the right-hand side for a long-term performance view. Longer durations offer more reliable data.

- Analyze the Graph: Examine the fund’s performance line (dark blue) against the benchmark line (brown). The fund’s line should ideally remain above the benchmark line consistently.

Now look at the dark blue line which shows the fund’s performance vs the benchmark which is the brown line of the BSE 100 TRI.

In this example, clearly the fund was ahead of it’s benchmark until early 2022 and then started under performing the benchmark from early 2023

Of course, most people advise that one shouldn’t be too hasty to exit a fund when it’s under performing. Ideally you should give a fund some time and a chance to recover. But how long you should allow the fund to recover is up to you.

Important Watch-Outs

Benchmark Changes: Occasionally, funds change their benchmark after a name or mandate update. The new benchmark might be easier to beat, making the fund’s historical performance appear better than it truly is. Always verify that you’re using the correct benchmark for comparison.

Caveat for small cap funds: Many small cap funds seem to be beating the small cap Index but fail to beat the mid cap Index

If you would like an excel sheet template for evaluating a fund’s performance based on the above criteria, message me and I’ll be happy to send it across.