Key takeaway

- This is, in my view, one of the best kept secrets of Investing

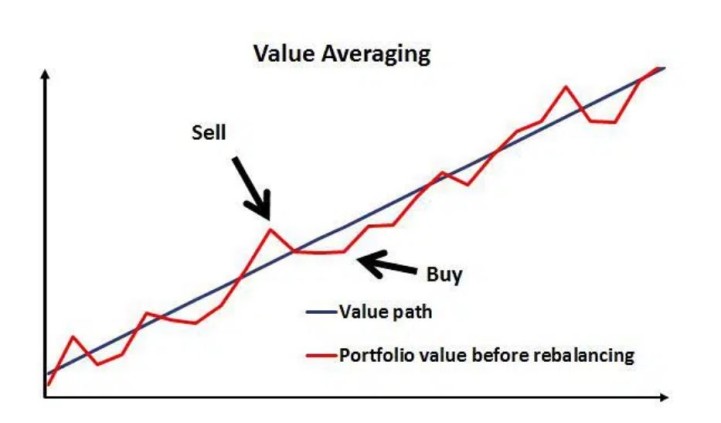

- Value averaging is a method like SIP and rebalancing done together

- Value Averaging is a method developed by Harvard Professor Michael E Edleson

- This method is endorsed and recommended by Dr. William Bernstein, who has authored over 10 books on investing, is often interviewed by CNBC and only handles portfolios larger than $ 25 Million

- It forces you to buy more (than SIP) at market lows than at market highs (when compared to SIPs)

- It provides clear “sell” signals to profit from short term market over reaction

- It forces you to avoid big moves into a peaked market or panic selling at the bottom

- At the extreme, in a beaten down “bear” market SIP yielded 11.25% while Value averaging: yielded 25.86%

- In general, Value averaging generates approx.. 1% higher absolute returns than an SIP. This may not seem like much but if we assume a 10% return on equity investments, then that is effectively a 10% increase in return.

- If you get lucky and you have a crash during your 5 year value averaging cycle you could make enormous gains.

- It is best to do value averaging once a quarter (rather than monthly) over a one to five year period

- You need to ensure you are increasing the value of your quarterly investments every year

Introduction

From all that I’ve read over the past 20 years on investing, this is, in my view, one of the best kept secrets of Investing. From all the reading I’ve done on this subject, there are just a few things that an investor can do to really ensure his chances of generating higher returns. Value averaging is one of the top 3 to 5 such things that an investor can do in my opinion. Buying Index funds as suggested by Warren Buffett is one of the other such things one can do to reliably increase one’s returns.

Traditionally, most of us (myself included) have built up our investments in equity mutual funds by setting up systematic investment plans. This article presents a new method / system developed by renowned Harvard Professor, Michael E Edleson by which one can build up one’s investments in Equity Mutual Funds. If you find this article interesting and would like to dive deeper into Value Averaging, you could read Michael’s book, Value averaging.

Value averaging recommended by world renowned Investment guru and author

When one of the wisest investors in the world, Dr. William Bernstein, recommended Value Averaging as the best way to build up one’s equity allocation, I sat straight up in my chair & paid close attention. Dr. William Bernstein has written over 10 books on the subject of personal finance & investing and typically only handles portfolios in excess of $25 Million. He is also frequently interviewed by media houses such as CNBC.

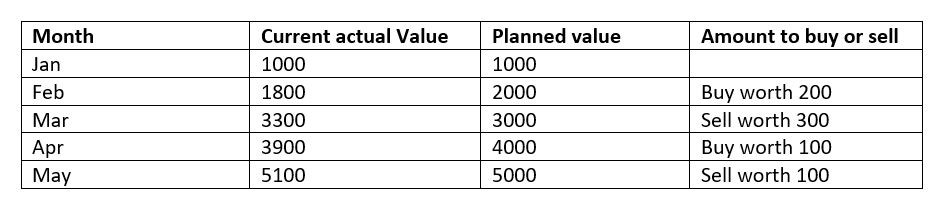

The simple concept of Value averaging

In short, Dr. Bernstien describes it as SIP and rebalancing done together. Here you focus on the CURRENT VALUE of your equity investments and ensure that the market VALUE of your investments increase by a set amount every month. The table below should help make it clear.

Benefits of value averaging

In short, here are a few reasons why Value averaging works better than a standard systematic investment plan method.

- Forces you to buy more at market lows than at market highs (when compared to SIPs)

- Results in a lower average purchase price per unit

- Provides clear “sell” signals to profit from short term market over reaction

- Forces you to avoid big moves into a peaked market or panic selling at the bottom

- As a result of all the above, usually provides higher returns than an SIP

Data & research on the results of Value averaging Vs SIP

Ok so I hear you say the approach & principles sound right but how does it all pan out in practise? Does this really yield better results in the real world? To substantiate that I quote data from Michael’s book. This is based on data from 1926 to 1991 of the US stock market. I have summarised conclusions of his from two sets of data. One set is based on Value Averaging done over a 1 year period and the other from Value averaging done over a 5 year period.

For 1 Year periods

- Value Averaging had a higher return than SIP for 58 of the 66 years analysed from 1926 to 1991

- When it beat SIPs it was on average 1.24% higher than SIP and when it lost it was on average 0.58% lower than an SIP

- Over 66 one year periods value averaging was higher than an SIP by 1.16%

- At the extreme, in a beaten down “bear” market SIP yielded 11.25% while Value averaging: yielded 25.86%

For value averaging over 5 year period

- Value averaging had higher returns than an SIP in 52 out of 62 5 year periods.

- On average Value Averaging was higher than an SIP by about 1.13% than SIP for 5 year periods

There is one HUGE potential benefit of value averaging above that the above data does not convey. And that is if you happen to be doing Value Averaging during a crash in the market. So if you get lucky and you have a crash during your 5 year value averaging cycle you could make enormous gains.

Key execution related points for value averaging

If you decide to give this method a try, here are a few key points to keep in mind while putting it into practise.

- As per research, value averaging is best executed quarterly or once every 4 months.

- Value averaging has also been shown to work best over periods of 1 to 5 years.

- It is also particularly important to increase the value of your quarterly contributions to keep pace with market growth. This is called Growth equalised value averaging.

Benefits of an SIP

Despite the fact that Value Averaging does seem to get better results than an SIP, there are benefits of the SIP method. I followed the SIP method myself for approx.. 20 years. It is no doubt a well proven and time-tested way to build up one’s equity investments. Fundamentally, SIPs have 4 fundamental advantages. It helps you

- Avoid the pitfall of trying to time the market

- You buy less when prices are high & vice versa

- It makes one disciplined about investing

- It is simple & easy. Once set all is on auto pilot

The discipline it instills and the extreme ease of setting it up and putting things on autopilot are in my view perhaps some of it’s strongest advantages.

Summary

Value averaging is like SIP and rebalancing done together. It was developed by Harvard Professor Michael Edleson and is highly recommended by Investment Guru Dr. William Bernstein. On average it will likely enable you to get 10% higher returns than an SIP (assuming average absolute returns of the stock market are 10%). Some of the greatest advantages of this method is that it forces you to buy more than an SIP during market lows or crashes and prevents you from doing anything foolish during a crash or a market peak. If you get really lucky and a market crash occurs during your 5 year value averaging period, you can make incredibly high outsized returns. It is important to keep increasing your investment amount each year. An SIP is indeed easier and less time consuming but the extra effort punt into value averaging results in a higher return. If you are very busy at work or otherwise, an SIP might still be a better route for you.

Disclaimer and background: I am not a financial advisor. My articles are meant for people who are not savvy or well versed with personal finance and investing and find it difficult to grasp all the jargon typically used when discussing such topics. I hope to be able to demystify investing and make it as simple as possible for everyone. Even a child in the 8th standard should be able to follow and learn the simple basics of investing. I also hope to educate people enough to avoid the many pitfalls and traps they could fall into given the nature and structure of commissions in the Mutual Fund Industry.

I am merely someone like millions of other common folk who have been investing in Mutual Funds. I’ve invested in Mutual funds for approx. 22 years. I’ve also been a diligent student of the subject of investing over the past 22 years. In these articles I’m merely sharing my experience & learning from that journey in the hope that it might help others in some way. Neither am I in any way directly or indirectly claiming to be a hot shot investor who has generated exceptional or above average returns during my investment journey. However, I am quite confident that even if all you do is learn from my mistakes and don’t repeat them, you will benefit greatly. Please ensure that you consult a financial advisor before taking any decisions or actions concerning your personal finances or investments.