Key takeaways

- Retirement is typically a 30 to 40 year period

- Prices can increase very significantly (12 times or even much more) over such a long period This is Inflation.

- Equity / investments in the Indian stock market have over 10 to 15 year periods typically beaten inflation

- Hence if one wants to beat inflation, it is important to have some investments in equity i.e. the stock market.

- As I touched upon in my earlier article, on how much one needs to be able to retire, data & research suggests that at least 50% of one’s investments should be in equity i.e. the stock market

So what is inflation and why should you care about it?

In simple terms, inflation is the rate at which prices increase from year to year.

Retirement is a 30 plus year period these days. Over such a long period, prices of things we want to buy and things we want to do go up many fold. So if we want to be able to keep up a lifestyle that is somewhat similar to our current one, it is absolutely crucial that at least some of our retirement savings are invested in assets that can at least keep up with if not beat inflation. The only other alternative would be to cut down drastically on one’s lifestyle In one’s retirement years. For example, you might need to take less or shorter vacations, eat out less, move to a smaller home or a different locality, shift from a car to a bike etc etc.

Some stories of inflation

This is a story that dates back say 40 or 50 years ago. One of the first five star hotels in Pune had recently opened. An uncle of mine and his friends got together at a party around that time and naturally the conversation turned to the recent news about the grand opening of the Five star hotel. The hotel opened and was offering rooms at the princely rate of Rs. 50/- per day for a room. My uncle and his friends all laughed at the ridiculously high rates and predicted that the hotel would be out of business and probably shut down. Last December when I checked, the hotel was offering rooms at Rs. 9,000 plus taxes per night. That’s an increase of well over 180 times the original opening price ! Now that’s inflation !

I can recall my dad telling me that when he was a young boy, they could fill up their car with petrol i.e. full tank in just Rs. 100/-. And mind you, those old cars had large capacity tanks. I can also recall my parents saying that flats in posh south Mumbai were available for Rs. 30,000/-. Today I doubt anything is available in the same area for less than say 2 crores. That’s a 600 fold increase in price over the last say 40 years. Now that’s inflation !

I also remember my grandma saying that she could buy Chicken at say something like 50 paise per kg. Today it’s probably Rs. 200 per kg. That’s a 400 fold increase.

Ok, I realise that I’m probably quoting extreme examples like property in Mumbai and I’m taking very long periods into consideration. But this is just to illustrate more clearly the point about how inflation can impact you in the long run. I’m sure you will have such stories from your own personal life and experience that you could reflect on.

Examples of actual price increases over recent years: Inflation data points

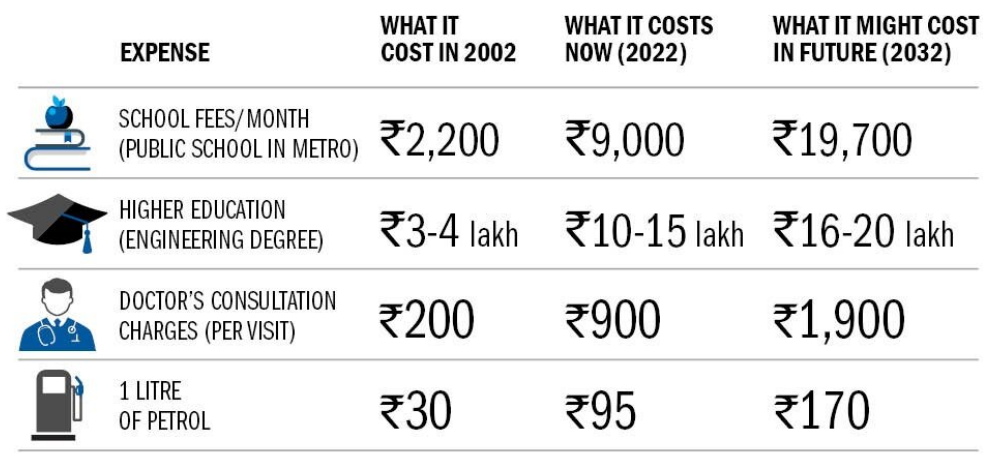

Let’s step away from anecdotes and look at a few sample data points. The chart below from an article on inflation by Value research shows more recent data from the past 20 years.

Let’s go on to look at real estate. Data from this ET article shows that on average home prices went up from Rs. 4,063/- per square foot in 2010 to Rs. 5,599/- per square foot in 2020. This means that the same house that cost say Rs. 40 lakhs in 2010 costs Rs. 56 lakhs in 2020. In effect, this means that if you hadn’t invested your money in an area that keeps up with inflation, you would have to settle for say a 2 bedroom house instead of a 3 bedroom one. That is one example of the impact & effect of inflation.

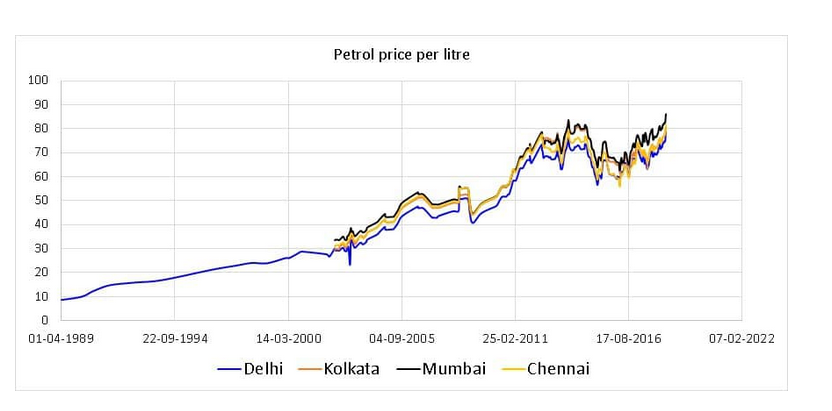

We could further look at another everyday commodity, Petrol. Petrol price data from this article on Free fincal suggests that one litre of Petrol in 1989 cost Rs. 8.50/- today we all know it’s over Rs. 100/- per litre. Let’s say your car gives you mileage of 12 km per litre in the city. In effect, this means that if your hadn’t invested your money in an area that keeps up with inflation, then with Rs. 100/- in 1989 you could have travelled 144 km and today you can only travel 12 km with that same amount of money. This would have a significant & increasing knock-on effect on the budget you need for holidays and road trips as well.

What does this mean for retirement planning?

Thanks to better overall healthcare over the past decades people are living longer than earlier. In addition, due to increasing salaries in India over the past couple of decades many people would likely have the choice to retire earlier than the traditional age of say 58 or 60. As a result, retirement which was typically a case of retiring at 60 and living till you were 80 or 85 years old i.e. a phase that lasts say 25 years, is now a phase in which people want to retire when they are 50 and will likely live till they are 90. i.e. a phase that lasts 40 years.

As we’ve seen with a few of the examples above, prices can rise very significantly over a span of 50 years. So I reiterate here what I mentioned above: If we want to be able to keep up a lifestyle that is somewhat similar to our current one, it is absolutely crucial that our retirement savings are invested in assets that can at least keep up with if not beat inflation. The only other alternative would be to cut down drastically on one’s lifestyle in one’s retirement years. For example, you might need to take less or shorter vacations, eat out less, move to a smaller home or a different locality, shift from a car to a bike etc etc.

Investment in equity to beat inflation

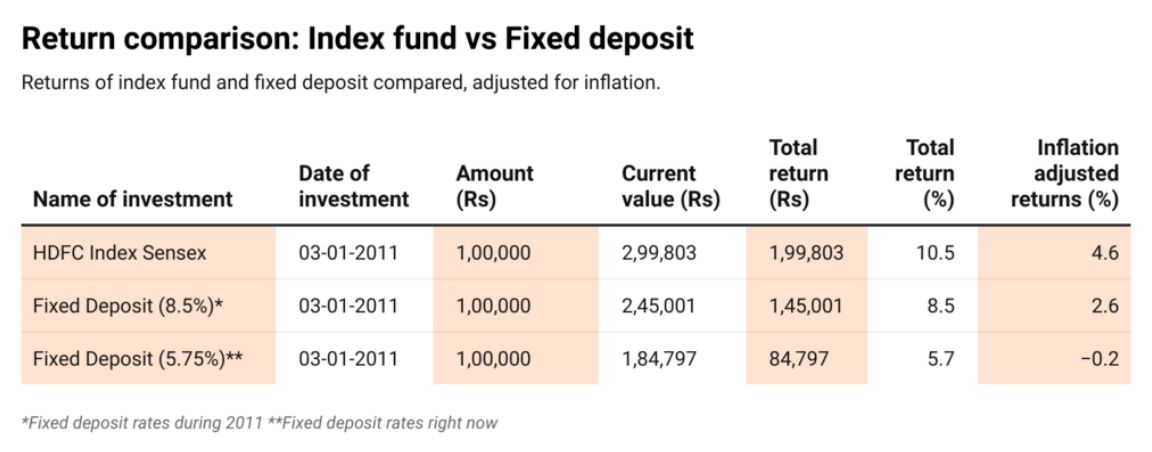

Historically, investments in the stock market such as equity mutual funds, have beaten inflation over long periods of time i.e. when invested for 10 to 15 years or more. As a sample data point, the graphic below from an article by Value research shows that from 2011 to 2021, equity returns beat inflation by 4.6% while an FD giving 5.75% returns returned 0.2 percent below inflation.

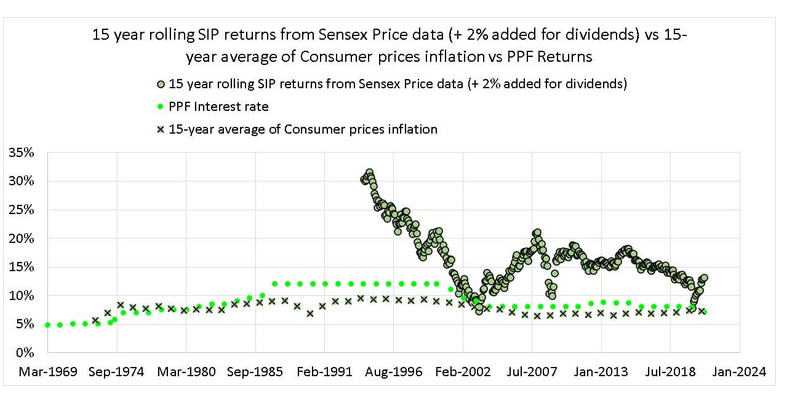

The above was just one sample data point. To validate the data further, have a look at the graph below from an article on free fincal. It shows that over a 15 year period, Sensex returns (green dot with a black circle around it) have consistently stayed well above inflation ( the black X)

Summary

In summary, inflation is an invisible monster that quietly erodes what you are able to buy using a certain amount of money. Since retirement is a 30 to 50 year period, over such a long period, inflation could very significantly erode your ability to continue to live the same or a decent lifestyle.

Equity (i.e. investments in the stock market) have a track record of being able to beat inflation IF invested for a 10 to 15 year period. Hence, if you don’t want to have to significantly cut back on your lifestyle during your retirement years, it’s important to have a significant portion of your investments (say a min of 50% to a max of 75%) in stock market linked investments such as Mutual Funds.